We take a look at the key themes from over 200 submissions to Treasury on whether we mandate climate-related financial disclosures in Australia.

Inside Responsible Investing

As the need for ESG practices and regulation grows across the Australian financial services industry, Dugald Higgins, Head of Responsible Investment and Sustainability at Zenith shares his insights and commentary as the ESG landscapes evolves. With continued growth and change anticipated within the ESG space, Dug breaks down what this means for investors, advisers, and businesses.

|

Let's talk about climate reporting, a hot topic around the world. In Australia, there's been a lot of debate around climate issues for the last 30 years, but things are starting to change. In December 2022, the Treasury launched a consultation to consider mandating climate-related financial disclosures for key segments of the financial markets. While it's still early days, and the proposal is still being refined, there have been nearly 200 public submissions, giving us some insights into what might be coming next.

Trade, regulations and money – the ties that bind

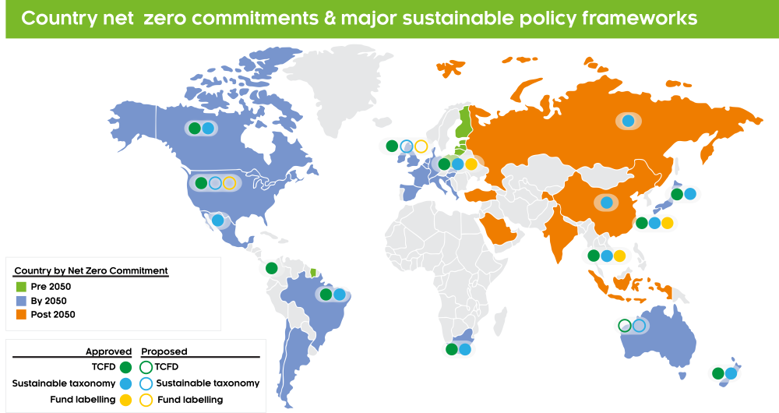

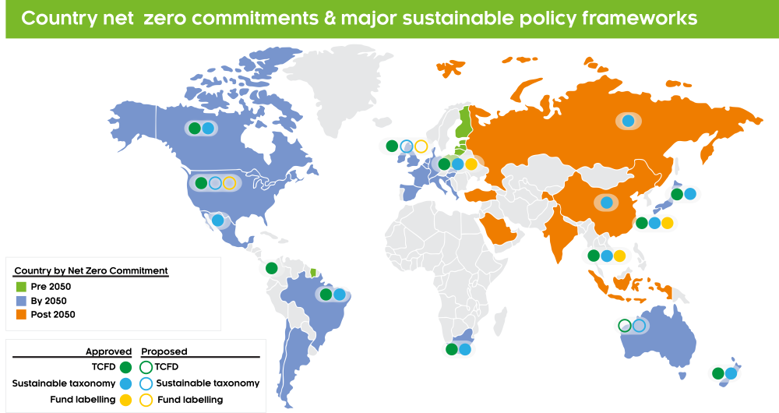

The basic idea of the proposal is to introduce a standardised, internationally-aligned set of reporting requirements for climate-related and sustainability disclosures. This is important because the world is interconnected by flows in trade, capital, people, and data. As these flows intensify, cross-border regulations are also increasing, and one of the fastest-growing regulatory races is around sustainability.

While there is still a lack of global consistency in regional approaches, convergence is happening, and many countries are mandating greater disclosure on climate risk, sustainability, and green labelling of economic activities and capital market instruments. Investment funds have significant offshore exposure, and many countries that Australia trades with have net-zero emissions pledges in place. If Australia doesn't engage in common standards, it could be detrimental to businesses and trade.

Source: OMFIF Sustainable Policy Institute, Zenith Investment Partners

What is the market saying about the proposal?

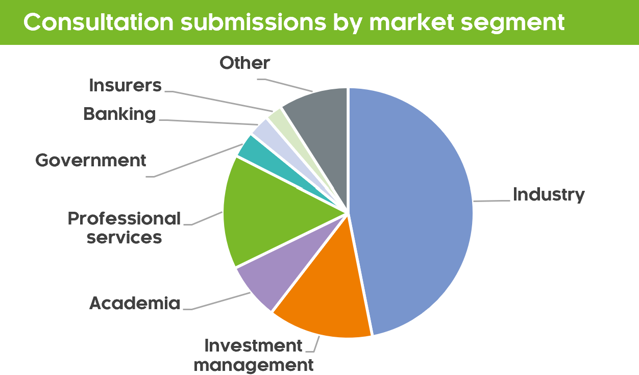

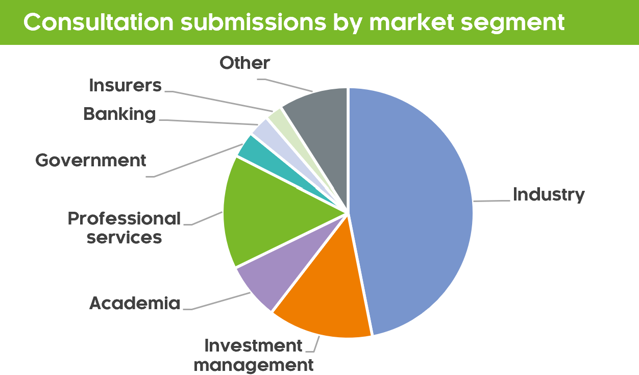

Treasury have released 180 public submissions as part of the consultation. Given the consultation potentially aims to capture large-listed entities, we have aggregated these principally into ‘industry’, banks, insurers and superannuation (investment management). With each category, where appropriate we have also grouped responses from relevant industry bodies.

In summary, we saw over 65% of submissions come from ‘industry’ and yet Treasury also received a large number of responses from groups that that may potentially benefit, such as services providers, like professional services and consulting firms. It is these opinions and voices which will likely play a critical part during the implementation and assurance of any industry changes, and so we hope their feedback is weighted equally during the consultation.

Source: Treasury, Zenith Investment Partners

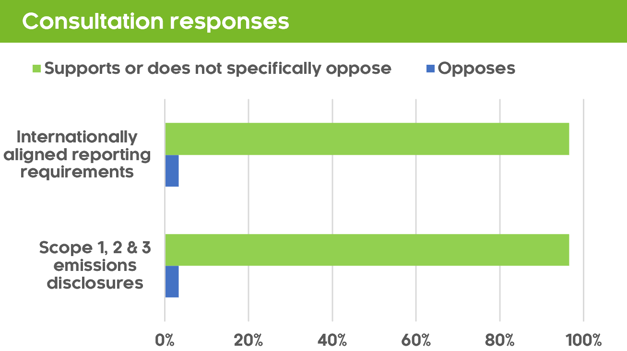

From the consultation, there are two driving questions:

- Should Australia seek to align our climate reporting requirements with the global baseline envisaged by the International Sustainability Boards [ISSB]?

- What considerations should apply to requirements to report emissions (Scope 1, 2 and 3) including use of any relevant Australian emissions reporting frameworks?

For arguments sake, we have simplified these questions:

- Do you support, or not specifically oppose, aligning with international climate reporting standards?

- Do you support, or not specifically oppose, reporting Scope 3 emissions?

We have simplified these questions for two reasons. Firstly, although the current policy proposals for standardising reporting around climate standards globally shows broad support for the ISSB, it is yet to be categorically finalised. And while ISSB extends the remit of the TCFD, we believe looking at support for the broad principals is probably more important than the specific question as posed for now.

Secondly, the issue of Scope 3 - carbon accounting, has been highly topical globally. The calculation of Scope 3 emissions result from activities in assets not owned or controlled, but which a company indirectly affects in its value chain. As such, reporting Scope 3 will be a highly complex scenario for most businesses. We feel this is one of the most significant challenges for the market.

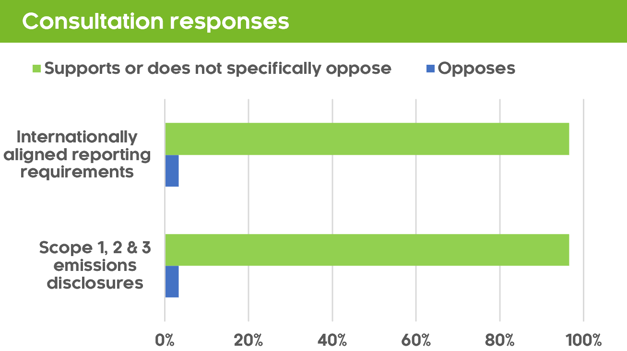

So, what have we observed? Has the market supported or rejected these key issues?

Source: Treasury, Zenith Investment Partners

Based on our review of responses, the markets answer has been resoundingly supportive. In both cases, over 95% of respondents appear to have supported these two aspects of the consultation. That is not to say there are not caveats attached, but outright rejections have been few and far between.

Why is this important?

Most of the submissions come from those who are going to bear the burden in increased reporting, this is a key indicator that we’re likely to be embracing mandated disclosures sooner rather than later, noting that Treasury have suggested reporting could kick off as early as 1 July 2024. This highlights that those businesses not already considering or undertaking reporting on climate issues are going to need to start thinking about what that means for them.

The adoption of these changes will likely need to be quicker than first thought. Businesses are going to need to rapidly assess a wide range of activities across governance structures, financial information systems and reporting practices in order to deliver robust outcomes.

It’s also important to note, virtually none of the submissions have rejected Scope 3 emissions reporting. Yes, many do note that these disclosures should only be required once a more robust and consistent framework can be applied, and the ISSB have themselves indicated extending out timing on Scope 3 reporting due to its complexities. But adoption is very likely.

This means businesses needs a shift in mindset, that sustainability issues are not being examined in isolation, but rather in company value chains. Scope 3 reporting means that many technically out-of-scope companies will need to start providing emissions data so that companies which are in scope can aggregate their own positions.

This ripple effect on many sustainability issues is already happening, with regulations across the world increasingly capturing companies whose revenues and value chains extend offshore. While to date this has been centred on large multinationals, accelerated change is coming for much more of the market.

Bearing the burden – business need to prepare for higher spend

Undeniably, climate reporting will increase costs to businesses. Studies in the US have suggested that the SECs proposed reporting requirements, which are broadly similar to the proposed ISSB guidelines, on average, are costing corporate issuers approximately $US 530,000 per annum to collect, analyse, and report climate data.

This highlights that Treasury needs to ensure the burden does not overwhelm smaller businesses as data is still hard to source and many approaches are still misaligned. Standardisation should however help bring down costs, as has been argued with standardisation of global accounting rules. Hopefully, a ‘fit for purpose’ approach to phasing in of disclosures can be delivered. Either way, business need to start planning now to understand what’s at stake.

The takeaway

Many large businesses already undertake sophisticated reporting on climate risks, but large gaps remain. Even for those already undertaking TCFD, meeting the requirements posed by the ISSB will require yet another change of pace. For investment managers who still think sustainability reporting is only for ‘green’ funds, you need to think again. And even if you don’t technically need to report, what are the implications of a massive increase in sustainability data across most of the market in which you invest? Information moves markets after all.

For financial advisers, the implications are more diverse. If only utilising third party managers, the issues will be more relevant regarding assessing what more reporting means for their investment approaches. If using direct equities with clients however, this may be very different. For firms which also provide services like business advisory or accounting, there is an increasing array of issues your clients should be aware of, least of all is the issues associated with greenwashing.

Ultimately, those less developed in climate reporting will have to level up resources to meet new thresholds of disclosure. This will take time to build out. There are no quick fixes. If you haven’t already thought about your emission profile, now’s the time.