Do you know what your clients really think about responsible investing? Perhaps the conversation should turn to what really matters to them first, before considering their RI options.

Inside Responsible Investing

As the need for ESG practices and regulation grows across the Australian financial services industry, Dugald Higgins, Head of Responsible Investment and Sustainability at Zenith shares his insights and commentary as the ESG landscapes evolves. With continued growth and change anticipated within the ESG space, Dug breaks down what this means for investors, advisers, and businesses.

|

While interest in responsible investing continues to grow, it’s inevitable that investor appetite for responsible investment vehicles will vary. For advisers and managers targeting direct investment channels with responsible funds, understanding that there can be a disconnect between the message and the receiver can be critical.

While the best market intelligence is direct one-on-one feedback, broader market surveys also play a useful role in pointing to key indicators of investor interest in responsible investing. Luckily, in finance and investing, there’s no shortage of market surveys to choose from. We think that several recent investor surveys point to some interesting indicators in responsible investing that show some material disconnects that can be addressed. By being aware of these asymmetries, advisers may be able to create clearer action paths for clients.

Great expectations

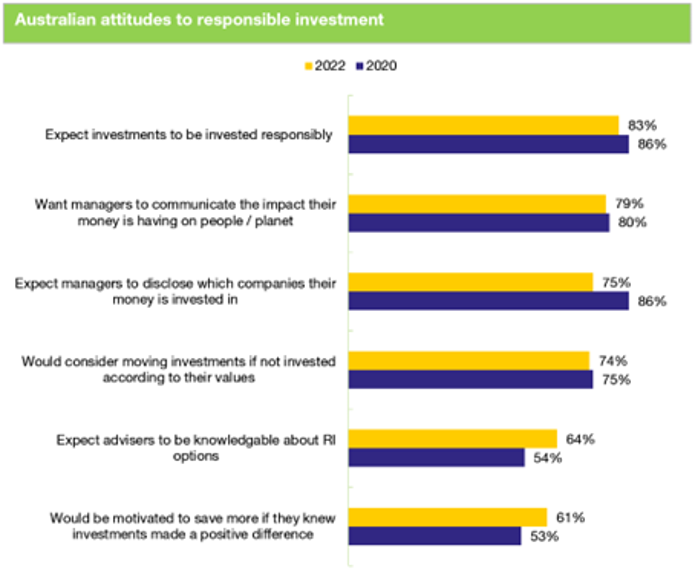

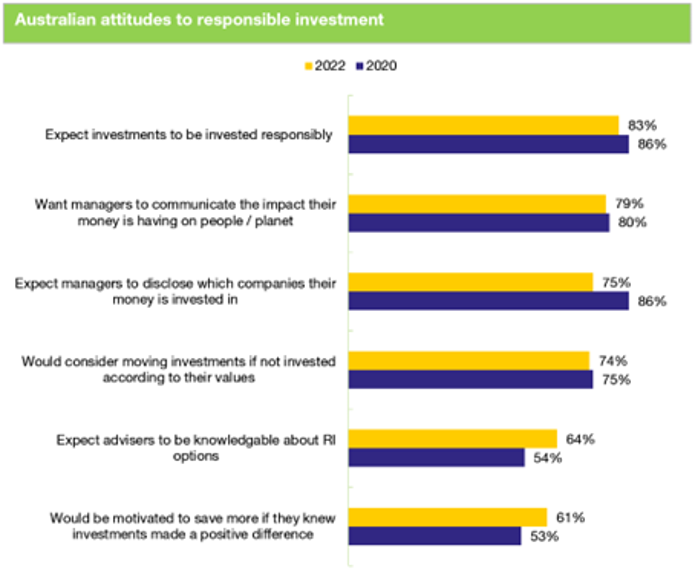

There are a number of surveys out there which indicate an increased level of appetite from investors for responsible investments. An excellent study is the From Values to Riches survey from the Responsible Investment Association Australasia (RIAA). There are a number of key messages in this report, with consciousness of responsible investing, expectations of providers and sensitivity to key issues like climate all rising strongly as material factors for investors.

Source: RIAA, Zenith

All this looks like a compelling reason for advisers to embrace responsible investing (if they haven’t already). But what if you’re one of the many advisers who quite legitimately say their clients have never asked about it? Does this mean that devoting time and resources to considering responsible investing for clients is a waste of time?

The answer of course is that surveys are, at best, merely a representative sample of an audience. But samples won’t always replicate the real world. Maybe your clients are demographically less likely to lean toward responsible investing, either by cohorts across age, location or some other factor, but how do you know?

While it’s not useful to compare one survey against another, we think there are several other surveys which show interesting indicators that could prove useful for advisers to determine if their clients have any interest in responsible investing, and whether these results point to opportunities.

Reading the room

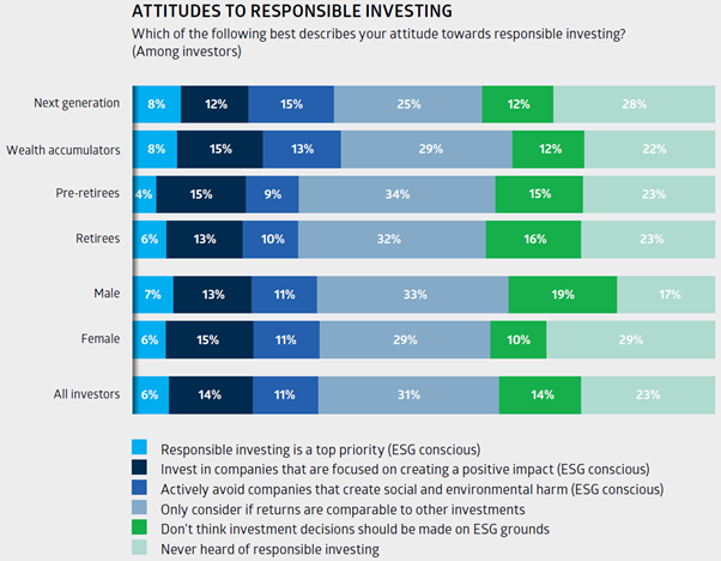

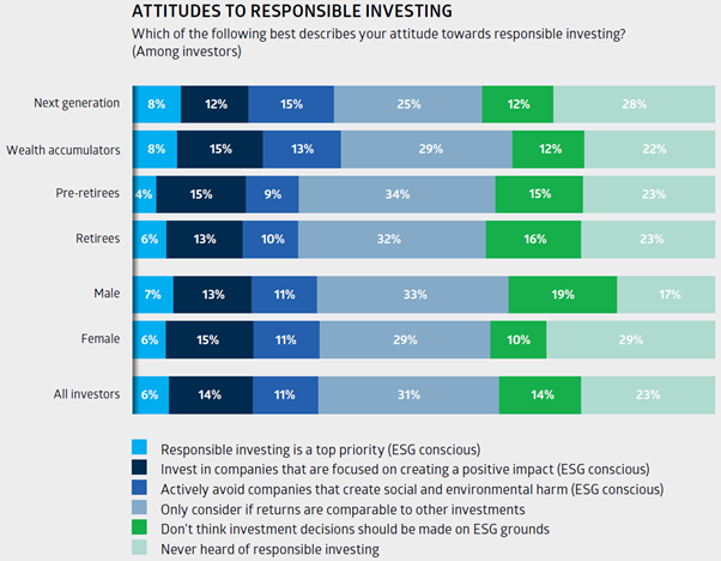

The ASX Australian Investor Study 2023 shows that, as expected, responsiveness to responsible investing varies across age and gender. While the ASX survey tends to be one of the more bearish on investor appetite for responsible investing, it does show an interesting opportunity for advisers.

Broadly, it indicates that while around one third of investors have attitudes sensitive to responsible investing issues, over half indicate that they would either consider responsible investing if returns were comparable to other investments, or, that they’ve never heard of responsible investing.

This suggests that advisers have room to engage on these topics further. While there’s a lot of argument around whether returns are ‘comparable’ or not, generally there’s support for the case that in most strategies, returns are broadly comparable over the longer-term. Responsible investments may be subject to different style and factor drivers resulting in dispersion of results, but this is no different to funds generally.

For those that are not familiar with responsible investing, this may be an opportunity to broach the topic. It’s one thing to be preaching to the choir, but based on this data, the opportunity may be opening up for conversations with those yet to be exposed to responsible investing.

Source: ASX

Actions speak louder than words

Despite not being a new concept, responsible investing suffers greatly from a lack of generally accepted views and terminology frameworks. There’s a bewildering array of terms like responsible, sustainable, ethical and ESG just to name a few. Problematically, not only is there no real consensus on what these terms mean, they’re often used interchangeably.

This presents problems on several fronts. Firstly, with no real industry consensus on terminology and definitions, it can be difficult for an adviser to translate a fund’s responsible investment attributes for their clients. Secondly, given that clients have varying levels of financial literacy, standardising conversations is of course not easy.

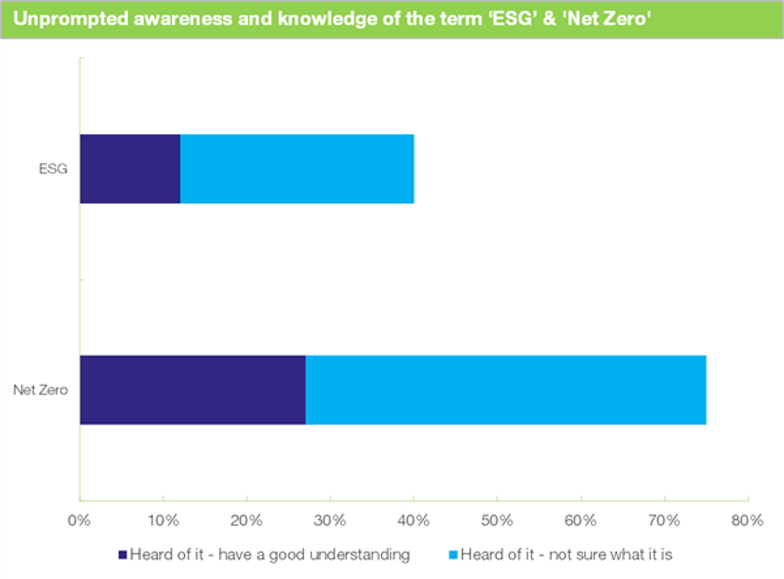

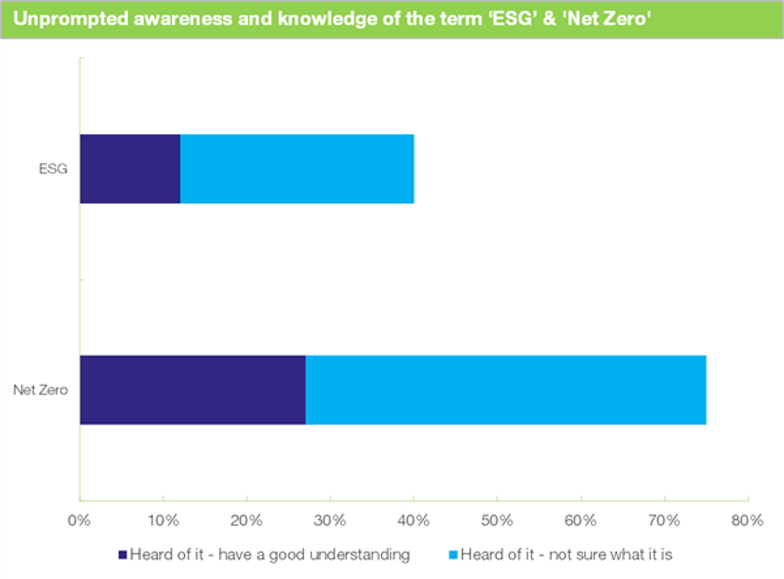

This is where the SEC Newgate ESG Monitor 2022 is interesting. Here we can see that based on this survey, awareness and knowledge of the term ‘ESG’ is relatively low at 40% of respondents. Conversely, this figure increased to 70% of respondents for the term ‘net zero’. This drives home an interesting point - even if knowledge may be lacking, actual awareness of Net Zero is significantly higher compared to ESG.

Source: SEC Newgate, Zenith

For most people the real world is easier to understand than industry jargon and there are therefore plenty of opportunities for education by advisers to help bridge these gaps. Issues like climate change or human rights are easier to fathom than talking about the Paris Accords or the UN Global Compact. What other topics might be best expressed by real world examples than by using jargon?

Advisers are already well versed in simplifying complex principles. Navigating the world of responsible investing is no different. Talking issues is easier than talking terms as a path to investor understanding.

Language – not labels

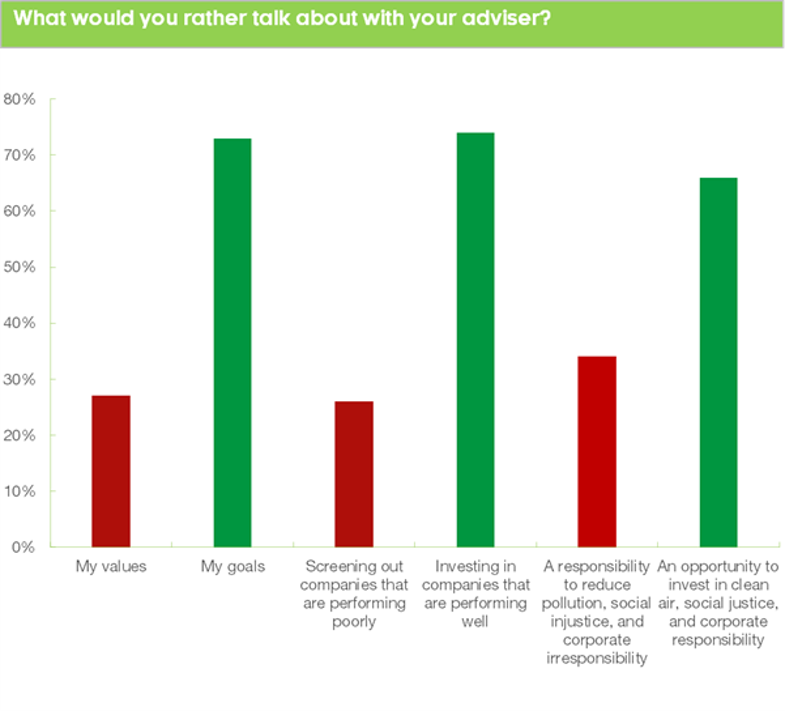

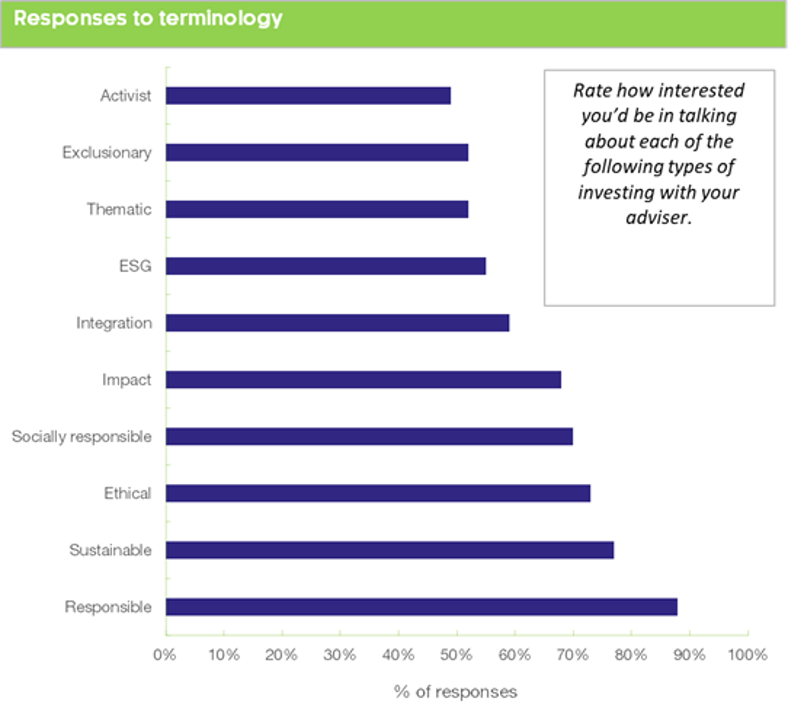

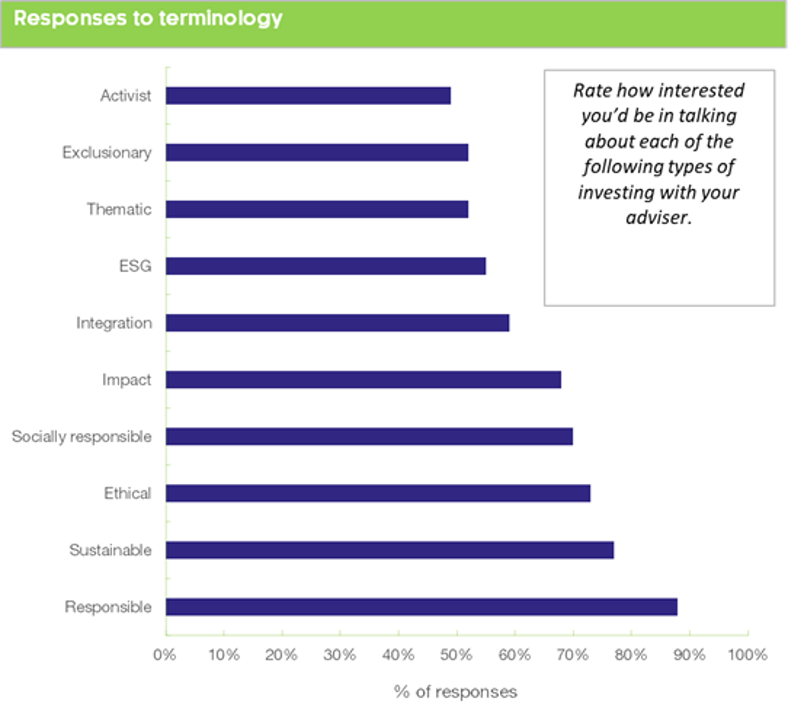

While we recommend focussing on concepts rather than jargon, it can be difficult to get away from it entirely. A 2022 report released by Invesco Global Consulting, ‘The First Word on ESG’, provides an interesting study on how investors feel about language with advisers. While based on North American investors, we feel there’s likely to be a high level of portability here.

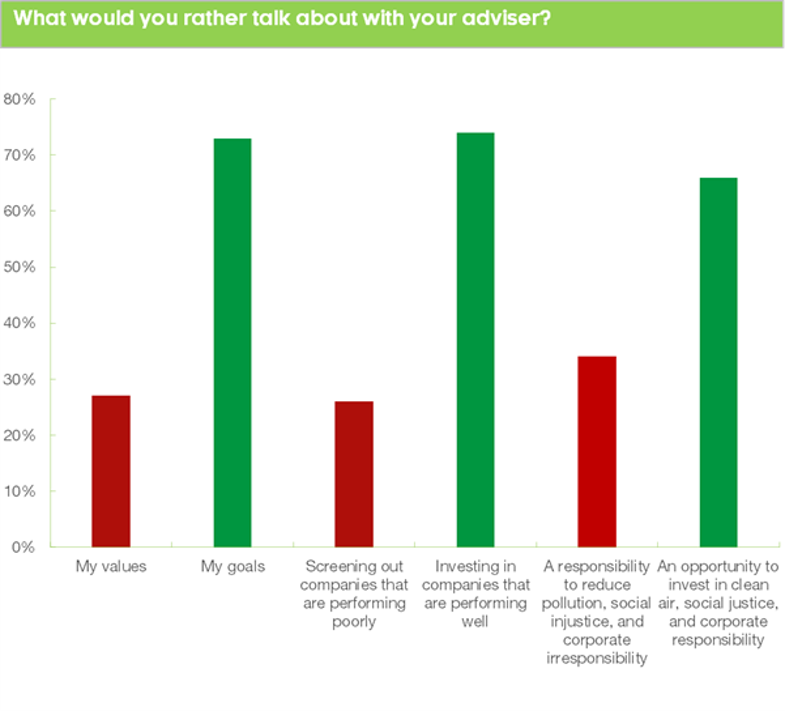

We feel three aspects are interesting. Firstly, clients were more comfortable talking about goals than values, the inference being that ‘values’ can be highly personal (particularly in initial client meetings) whereas ‘goals’ is more easily understood. Secondly, investors appeared to prefer to reward companies through investment rather than punishing companies by screening them out on ESG performance. And thirdly, investors appeared more motivated by opportunities than obligations.

Source: Invesco Global Consulting, Zenith

Clearly, there’s the suggestion that people respond better to an issue than a label. But even labels have power. The Invesco study also showed that even when using labels, simpler can be better. It’s about recognising what clients care about. Advisers can help them understand how it fits into a proposal or approach.

Source: Invesco Global Consulting

While there are clear implications for adviser conversations here, to a certain extent, this is nothing new. Clients often need help in articulating their goals and the things that matter to them, and a level of prompting is often needed. Thinking about responsible investing and sustainability issues in client wishes can be like goal planning. Often, clients need help articulating long-term goals because they don't know how to articulate it without a frame to put it in.

The takeaway

Ultimately, as interesting as they are, such surveys deal in generalities, not specifics. For every client who may respond better when talking about the positives, there are those who will find articulating their views on the negatives much easier. Some clients will have strong views on not including responsible investing as a consideration, while others just may not be familiar with the concept but are concerned about the issues.

What this does show is that understanding client appetite or sensitivity to responsible investment issues may not be as simple as thinking ‘if no-one’s asked, no-one’s interested’. Ultimately of course, the key to engaging clients is understanding what matters to the individual.

These market surveys are only indicators, not a definitive guide. And trends are dynamic, moving not only across demographics and issues, but also over time. However, there are many subtitles here that can be used to think about how to not only analyse trends, but breakdown any potential roadblocks to engagement. So the question may well be…what are your clients really saying?