ESG still lacks a clear consensus around definitions and regulations globally and as time goes on there’s a larger call to focus on the concept and not the label to truly make an impact for the end client.

Inside Responsible Investing

As the need for ESG practices and regulation grows across the Australian financial services industry, Dugald Higgins, Head of Responsible Investment and Sustainability at Zenith shares his insights and commentary as the ESG landscapes evolves. With continued growth and change anticipated within the ESG space, Dug breaks down what this means for investors, advisers, and businesses.

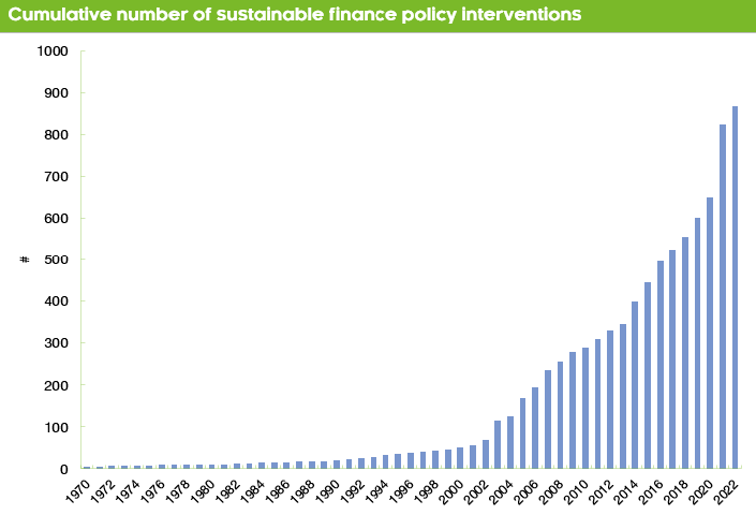

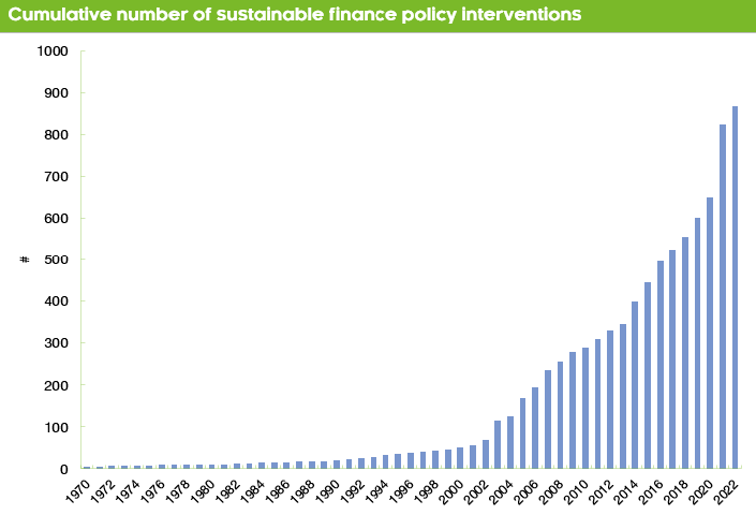

For years, environmental, social and governance (ESG), factors were seen as operating in a wilderness. Minimal regulatory guidelines. Lack of clear definitions. Lack of consensus on views. In the last five years, there’s been a significant increase of financial regulations and frameworks around the world, all seeking to try and achieve clarity on how to address ESG.

Source: PRI responsible investment regulation database - April 2022

Despite the rapid advancement in guidelines, the industry is still plagued by a lack of clear definitions or consensus. While the experts can’t agree, everyone else is caught in the middle. Trying to navigate a battleground of culture wars, political populism and label weaponisation is not helping anyone. How can a path be cleared?

Forget the label, look at the concept

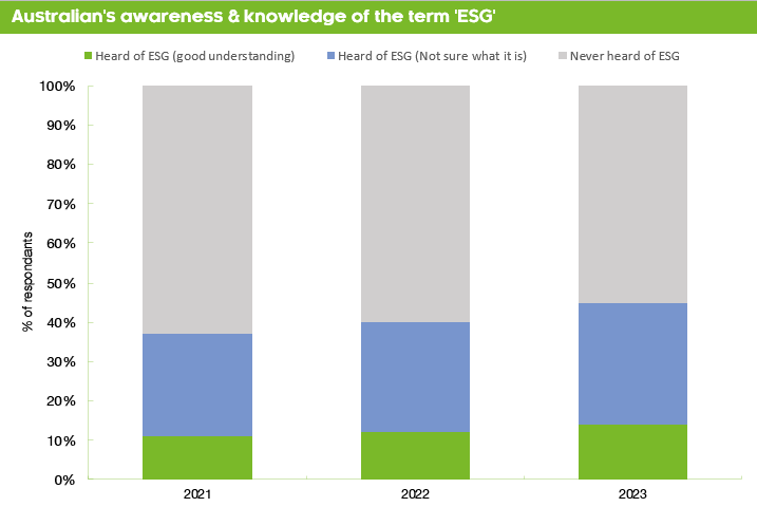

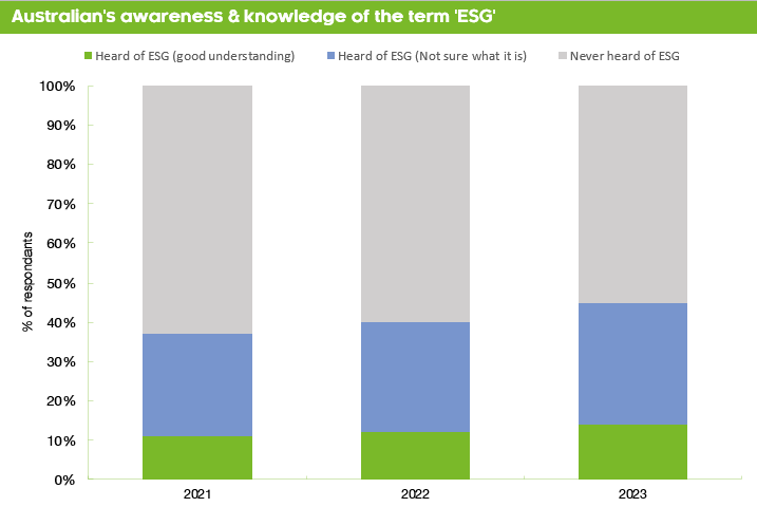

There are increasing calls to ‘kill off ESG’ from some commentators who, quite rightly, claim the term is either becoming meaningless, abused or just too confusing. However, we also note that these views are often being promoted as a platform to propose ‘better’ terminology. While we can applaud the sentiment, we think there’s a very real risk that this doesn’t actually solve anything. New definitions just increase the risk of being misinterpreted (which is bad) or misunderstood (which is worse). Given that some research suggests that ESG as a term remains poorly understood, as the following chart shows, ESG as a label seems to lack effective traction.

Source: SEC Newgate, Zenith Investment Partners

Naturally, we can’t do away with labels entirely. But to get to the heart of what’s happening, it’s arguably easier to lessen the focus on labels and focus on concepts instead.

Double trouble - single vs double materiality

A classic example of this is the intersection between ESG, sustainability and materiality. ESG and sustainability are often imprecise concepts, but thinking about it as actions rather than labels can make it easier.

Very simply, single materiality is the world’s impact on a company’s value. Double materiality takes this concept and adds on how the company’s operations impact the world. Problematically, both these can fall under some people’s label of ‘ESG’. But while related concepts, the intent and outcome of each is totally different.

Source: Zenith Investment Partners

This is important as confusion about ESG versus sustainability and/or ethics is still very common. We would argue that ESG and sustainability are very similar to single vs double materiality. ESG looks at the world’s impact on a company. Sustainability looks at a company’s impact on the world.

The problem of course is one of interpretation. You can be a company that manages ESG risks to the firm’s valuation very well (single materiality) while still being involved in controversial industries like gaming, fossil fuels or junk food that can cause meaningful harm to society (double materiality). Some ESG ratings are a case in point. For example, currently, Aristocrat Leisure, Woodside Energy and Coca-Cola all have high ESG ratings from one of the major ratings agencies. This is not to say the agency’s view is wrong, it’s that their methodology is measuring a company’s resilience to ESG risks, not applying any ‘green’ or ‘moral’ filters to their impact on society. In effect, these ratings are looking at single materiality, not double materiality. To many people, that’s not ESG, therefore the ESG rating is ‘wrong’. Let the arguments commence!

Making better decisions in ESG investing

If your selected ‘ESG fund’ is all about managing risk rather than investing in companies trying to lessen their impact on the world, you’re probably not going to be happy if you invested based on wanting to lessen the negative footprint of your capital. By ignoring the label and focusing on the action, you can potentially avoid misinterpreting what’s important when making choices.

These perspectives are also increasingly finding their way into formal disclosures. For example, Australia, the US and the UK are all in the final stages of mandating environmental single materiality standards into financial reporting for large numbers of both companies and funds. The EU however is effectively ‘doubling down’ by applying double materiality standards to reporting. Understanding the implications of forthcoming disclosures is going to be critical for businesses and investors alike.

We’d note that ESG isn’t the only label with potential for problems. Impact, stewardship, screening - all of these have the potential to be misaligned, misinterpreted or downright misguided if users don’t look at what’s actually going on under the headline. So, when looking at an investment, maybe forget the label. Look at the concept.

Right answer, wrong question

In this complex landscape, the emphasis should not be on finding the right answer but on asking the right questions. Regardless of the label, what truly matters is understanding what’s material to both businesses and society. It’s too important to allow labels to obstruct our genuine understanding of a company's impact and its role in the broader world. By shifting the focus from labels to concepts, we can work towards a more meaningful and effective approach to ESG and sustainability, ultimately contributing to a more responsible financial ecosystem.