The 2022 financial year proved to be a torrid one for investment markets. An uneventful first half year quickly turned ugly once the threat of global inflation became a reality. Unusually, listed markets in all the major asset sectors, including bonds, fell. In days gone by that would have meant a substantial fall for growth-type super funds, yet the median fund lost just 3.3% – all because of diversification.

The 2022 financial year proved to be a torrid one for investment markets. An uneventful first half year quickly turned ugly once the threat of global inflation became a reality. Unusually, listed markets in all the major asset sectors, including bonds, fell. In days gone by that would have meant a substantial fall for growth-type super funds, yet the median fund lost just 3.3% – all because of diversification.

Australia’s major super funds have a long track record when it comes to diversifying their investment portfolios. The not-for profit funds led the way back in the early days of compulsory super by investing meaningful sums of money in physical property and infrastructure as well as private equity. Since then, they have steadily increased their exposure to such assets. Some retail funds have recently followed suit, although their exposures to unlisted assets still tend to be much lower.

One argument in favour of unlisted assets is that because they are intrinsically long term and rarely traded, they command an illiquidity premium. This is the additional return above listed market equivalents to compensate investors for tying up capital in a less liquid asset. The other argument is to do with volatility. As these assets aren’t being continually re-priced in a public listed market (where price movements are heavily influenced by sentiment), their returns tend to be more stable and their inclusion in a growth portfolio helps to smooth the return path for members – especially at times of market volatility.

This latter characteristic was brought into focus during the GFC, which was the worst financial crisis in most people’s living memory. Super funds as a whole came through it well, largely because their diversification meant that the plunge in listed markets was cushioned by smaller falls in unlisted asset values. Since then, the diversification march has continued, with funds seeking out new sources of return that are less correlated with listed markets. They didn’t know when the next stress test would come, but they wanted to be prepared for it.

The onset of the COVID crisis in early 2020 provided the next major challenge. Listed markets moved in whipsaw fashion, first overshooting on the downside and then recovering rapidly. Again, diversification had a steadying effect and members were protected from the worst of the volatility.

And now the 2022 financial year has provided yet another test, and it’s fair to say that funds have passed it with flying colours. A negative annual return is never easy to digest, but a loss of just 3.3% must be considered a success when every listed market in the traditional asset sectors (other than cash) fell significantly. Indeed, the only meaningful positive return among all the public market sectors we measure came from global infrastructure.

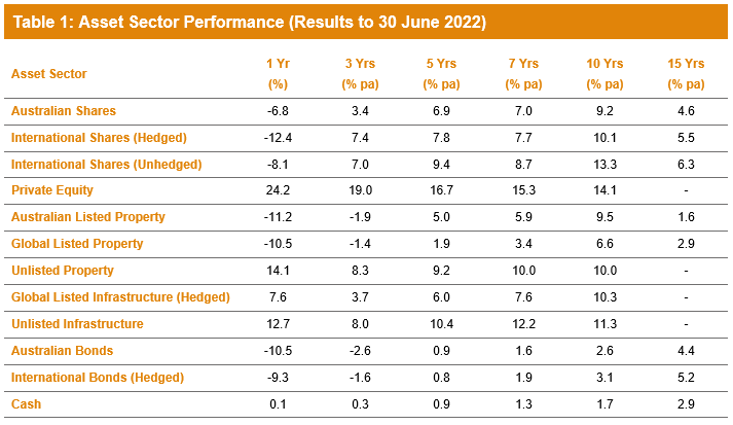

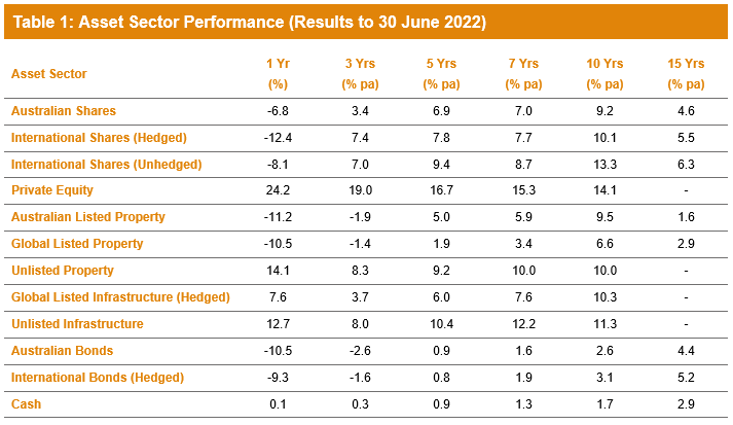

The heavy lifting in FY22 was mainly done by unlisted assets, as shown in below. Private equity was the outstanding performer (up 24.2%), while unlisted property (+14.1%) and unlisted infrastructure (+12.7%) were also strong. Higher exposure to those sectors was the main factor that drove the performance of the more successful funds over the year.

Source: Chant West

Note: Market indices are shown other than for private equity, unlisted property and unlisted infrastructure where we use the average returns of a small group of major superannuation funds. Unlisted sector performance is shown net of fees whereas for other sectors no fees are taken out.

Having said that, there were other levers that funds were able to pull which saved their performance from being worse, such as maintaining a lower duration profile within their bond portfolio. Those funds that had more of their share exposure invested domestically would have also benefited as Australian shares fared better than international shares.

It is worth reflecting on the sector returns in the table. It is unprecedented – at least in the past 30 years – to see negative returns in the same financial year from Australian and international shares, Australian and international listed property, and Australian and international bonds. And these were not marginal falls - they were substantial losses of about 7% to 12%. When we contrast those losses with the strong positive returns from unlisted sectors, we can clearly see the benefits of diversification.

The strong performance of unlisted assets will of course raise the perennial questions from some quarters about whether their ascribed values are realistic. However, we note that questions on the accuracy of unlisted valuations never seem to arise when listed markets shoot ahead of unlisted markets.

We saw during the GFC, and again in early 2020, that heightened volatility can see listed markets lose touch with the intrinsic value of the underlying assets. Even more recently, we’ve seen A-REITs lose 11.2% in FY22 only to rebound 10.8% in the month of July 2022.

We are comfortable that funds are taking their fiduciary responsibilities seriously. The frequency and timing of valuations varies but generally all assets are revalued at least once a year by qualified independent valuers, which are usually rotated from a panel of valuers every three years. These independent valuations are supplemented by more regular valuations (typically at least quarterly) conducted by external managers or, where the asset is directly held, by qualified internal teams with a deep understanding of the asset and the relevant market. This is important to ensure equity among all members.

Funds have learned from previous experiences about regular valuations and have become more proactive. We saw an increase in out-of-cycle, external downward revaluations in early 2020, as funds recognised the importance of maintaining equity during a period which saw heightened levels of switching. In our experience, funds’ valuation policies are generally sound, appropriate and working as they should. Unlisted asset revaluation practices are something that APRA is also keeping a watchful eye on.

The predictable impact of the performance test

While super funds have done a good job in difficult circumstances, we believe the results could have been better. That’s because some funds were inevitably influenced by having one eye on passing the annual performance test imposed by the Your Future, Your Super regime. The test has interfered with funds’ proper focus as long-term investors. It has shortened their time horizon and introduced tracking error risk to the equation, meaning that some funds have had to make compromises so as not to stray too far from the test benchmarks for fear of failing the test (this was especially the case for those funds not far off failing the test). Unfortunately, this has resulted in some of their ‘best ideas’ being taken off the table. Some examples of benchmark-related decisions we have come across include:

- a major fund removed its exposure to defensive equities and liquid alternatives from the accumulation variant of its more defensive diversified options (those with a 50/50 and 30/70 growth-defensive split). However, it retained those exposures in the equivalent pension options as it recognised those strategies were ideally suited to more conservative members. Those strategies proved their worth in FY22 and resulted in the pension variant of the 50/50 option outperforming its equivalent accumulation option by 1.7% (after adjusting for tax)

- another fund wound back its exposure to commodities just before that sector of the market produced particularly strong returns, and

- a couple of funds that had maintained a strong value tilt in their equity portfolios felt obliged to remove or pull back the tilt just as value regained the ascendancy over growth.

There has also been some pulling back from the search for new sources of return or pausing the implementation of high conviction ideas in light of the performance test. This is all to the detriment of members and represents an unintended (though predictable) consequence of the test regime which, while well-meaning, is flawed and in urgent need of refinement.

Funds still delivering for their members

While the FY2022 result was in the red, funds are nevertheless continuing to deliver on their promises to members over the long term. The typical long-term return objective that funds convey to members is to beat inflation by 3.5% p.a. which, with inflation having averaged just above 2.5% p.a. over the period, translates to about 6% p.a. So over 30 years, funds are nearly 2% a year ahead of what they tell members to expect. That should be a very reassuring message for members to hear.