Overview

When someone converts their super fund balance into a pension, their needs change quite significantly. For a start, their investment strategy needs to consider liquidity and capital preservation as well as growth, so they need their fund to offer appropriate investment options. These may be different from, or additional to, those available to super members.

The services that pension members require from their fund change, too. They need help to manage their money and make it last as long as possible, while still drawing the income they need. They may also need help in understanding the interaction between their super and the Age Pension. Estate planning can be a major issue for many pension members, and they need to be aware of the options available to them so they can plan accordingly.

Choosing a good pension fund is important, but without help the average person has no reliable means of comparing one fund with another. That is the purpose of our pension fund ratings. By applying our knowledge and experience of pension funds, we compare them in a way that is both fair and rigorous.

The result is a set of ratings that encapsulate our view about the quality of each fund we rate. We express those ratings in terms of Apples, reflecting our ‘apples with apples’ approach. Funds earn a rating ranging from 5 Apples, our highest grade, to 1 Apple, our lowest.

Our ratings are based on information that is either publicly available or is provided directly to us by the funds themselves. Where necessary, we modify that information to ensure fair comparisons. We give each fund the opportunity to review the information we use for its accuracy.

Chant West Pension Fund Ratings

5 Apples – Highest Quality is the highest Chant West rating for a pension fund. To earn 5 apples, a pension fund must have scored highly across most of our key areas of assessment which include investments, member services, fees and organisation.

4 Apples – High Quality is the highest Chant West rating for a pension fund. To earn 4 apples, a pension fund must have scored highly across most of our key areas of assessment which include investments, member services, fees and organisation.

3 Apples – Fair Quality is the highest Chant West rating for a pension fund. To earn 3 apples, a pension fund must have scored highly across most of our key areas of assessment which include investments, member services, fees and organisation.

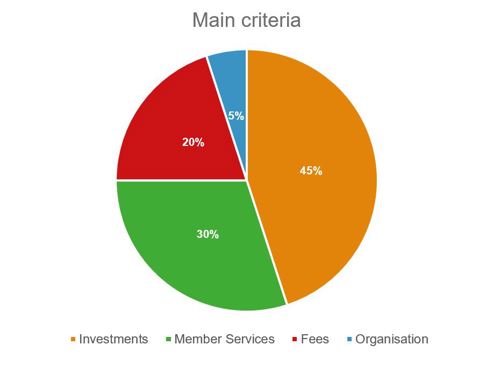

Main Criteria

When we rate pension funds, we apply a methodology that was first developed in 1997 and has been continuously refined ever since. We focus on four main criteria: investments, member services, fees and organisational strengths.

We determine a score for each of the main criteria and then weight these to provide an overall rating for the fund.

In the following sections we look at each of the main criteria in turn, starting with the most important, and explain the sub-criteria we assess.

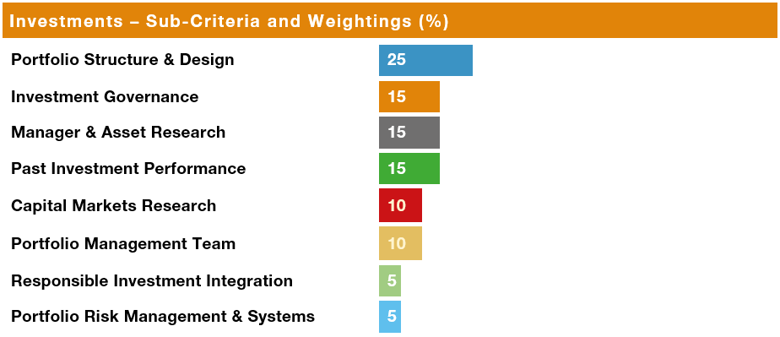

Investments

Investments are obviously important and account for 45% of our overall rating for pension members. When we rate a fund's investments, we do not focus on past returns. Rather, we focus on assessing the quality of the fund's investment governance, its in-house investment team, its external asset consultant (particularly for research), and the structure of its investment portfolios. If it does these things well, it is likely to have strong, long-term performance.

Most funds offer a range of investment options to choose from, but we concentrate our research mostly on the multi-manager options because that is where most members are invested. The chart below shows what we take into account. It is worth noting that past performance only accounts for 15% of the total score for investments (which equates to 6.75% of our overall fund evaluation).

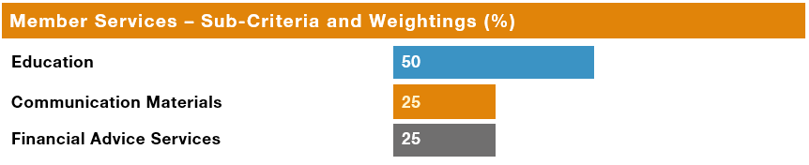

Member Services

While investments carry the highest weighting in our ratings process, we believe member services are also vitally important for pension members. For that reason they account for 30% of our overall weighting.

The best funds offer services that help their pension members to (i) understand the options they have in retirement and (ii) arrange their super to give them the income they require, while providing some capital growth to make it last as long as possible. Retirees need to be able to model different scenarios to see the effect on their pension balance of different investment choices and drawdown strategies. They also need to be able to take into account any Age Pension they may be entitled to, either now or in the future.

Members need help in various forms to meet all of these needs. The main aspects that we focus on when rating a fund on member services are education (public website and secure website), communications ex-advertising and promotional materials (member statements, campaigns and newsletters), and financial advice services. The chart shows those sub-criteria and the weightings we assign to them.

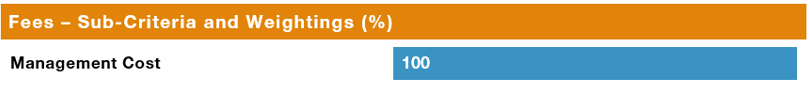

Fees

The fees that a member pays – either directly from their account or indirectly through their investments – have a bearing on how much income they end up with and how long their money lasts. However, a low fee fund is not necessarily the best. A fund may be cheap because its investments use a lot of passive management, or it may cut costs by providing little in the way of member services.

When we assess a fund on fees, we look not only at the costs that the member pays, directly or indirectly, but also on how clearly and completely the fund discloses those costs, as shown below.

Organisation

Australian super funds are highly regulated and they are not geared, so the chance of failure is quite remote. Nevertheless, it is important to know that the organisation behind the fund has the capacity to sustain and improve it now and into the future.

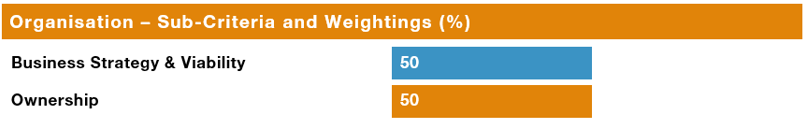

When we assess a fund on organisation, we look at who owns or controls it, the strength of its management team and its strategy for the future, as shown in the chart below.

Disclaimer: ©Zenith CW Pty Ltd ABN 20 639 121 403 (Chant West), Authorised Representative of Zenith Investment Partners Pty Ltd ABN 27 103 132 672, AFSL 226872 under AFS Representative Number 1280401, 2023. This website is only intended for use by Australian residents and is subject to use in accordance with Chant West’s Terms of Use and should be read with Chant West’s Financial Services Guide. Products, reports, ratings (Information) are based on data which may be sourced from a third party and may not contain all the information required to evaluate the nominated product providers, you are responsible for obtaining further information as required. To the extent that any Information provided is advice, it is General Advice (s766B Corporations Act). Individuals should seek their own independent financial advice and consider the appropriateness of any financial product in light of their own circumstances and needs before making any investment decision. Chant West has not taken into account the objectives, financial situation or needs of any specific person who may access or use the Information provided including target markets of financial products, where applicable. It is not a specific recommendation to purchase, sell or hold any product(s) and is subject to change at any time without prior notice. Individuals should consider the appropriateness of any advice in light of their own objectives, financial situations or needs and should obtain a copy of and consider any relevant PDS or offer document before making any decision. Information is provided in good faith and is believed to be accurate, however, no representation, warranty or undertaking is provided in relation to the accuracy or completeness of the Information. Information provided is subject to copyright and may not be reproduced, modified or distributed without the consent of the copyright owner. Except for any liability which cannot be excluded, Chant West does not accept any liability whether direct or indirect, arising from use of the Information. Past performance is not an indication of future performance. Chant West ratings and research are prepared by Chant West and are not connected in any way to research and ratings prepared by any of our related entities.