Our Responsible Investment Framework

Defining and measuring how investment managers and superannuation funds integrate responsible investment (RI) practices into their investment methodologies is complex. Many factors influence this assessment and individual managers and superannuation funds place varying degrees of importance on each factor.

While it’s vital for managers and superannuation funds to be able to measure and demonstrate the role of RI in their investment strategies, we believe it’s equally important that investors can accurately identify which strategies meet with their needs and align with their investment beliefs.

To better support our diverse client-base, we’ve built a framework which aims to provide clients with increased RI insights, empowering them to make more informed investment decisions. Our robust fund classification system across both managed funds and superannuation investment options (‘Funds) helps investors understand the integration of a manager’s (or a superannuation fund’s) responsible investment themes into their processes and the associated impacts on the final portfolio outcome.

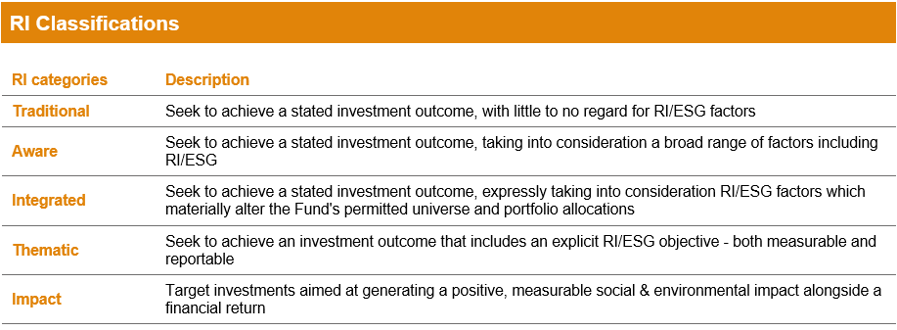

RI classifications – a tiered approach

There are five tiers within our RI framework. All funds holding a current Zenith Investment Partners investment grade rating and all investment options rated by Chant West receive an RI classification, noting that classifications are fund-specific and do not extend to the broader organisation level of an investment manager or superannuation fund.

Traditional approaches comprise active strategies with little to no regard for RI issues, and pure index strategies that don't factor RI screens or scoring when modifying exposures relative to their underlying index.

Funds in the Aware category broadly consider both RI factors and issuer engagement, but typically do so in a less structured and informal way.

Integrated funds utilise RI as a key component of their security selection and portfolio construction approach. In addition, detailed and transparent issuer engagement is also treated as a fundamental component of the investment management process.

The Thematic and Impact categories are extensions of the Integrated classification, with both required to display a robust assessment of RI issues and formal engagement to be considered for progression. Thematic funds invest specifically in themes or assets related to sustainability such as renewable energy, sustainable agriculture or affordable housing. While having many commonalities with Thematic funds, Impact funds must also be aimed at generating a positive, measurable impact alongside a financial return with full transparency.

The classification framework is underpinned by a set of principles which are overseen by an internal Responsible Investment Committee. We also use our role working right across the industry with a wide range of stakeholders to inform this framework and ensure it remains robust and relevant.

Our RI Principles

- Responsible investment promotes a sustainable economy, which is ultimately essential for investors and the integrity of capital markets.

- Responsible investment factors impact financial returns and risks.

- We seek to empower clients by providing tools and services for investors to select and monitor investment options.

- We recognise the diverse objectives under which both investors and managers operate. Values, investment styles, asset markets and jurisdictions are not homogenous. Accordingly, our approach to Responsible Investment supports the full spectrum of investment methodologies available.

- Where relevant, all investment professionals should consider material responsible investment factors when considering investment analytics and decision-making.

- We will seek appropriate disclosure on Responsible Investment issues by the investment managers and superannuation funds we review.

- Investment funds that claim to incorporate Responsible Investment elements should include adequate disclosures explaining the specific process being used, along with periodic verification that the stated processes are being followed.

- Responsible investment factors and associated issues are dynamic. Best practice dictates that continual research and monitoring are a prerequisite to adequately manage RI issues over time.

Zenith Group’s responsible investment framework is governed by Zenith Group’s Responsible Investment Policy which is available here.

For more detailed information about our RI review process, classifications and implementation of the framework, please contact us via: [email protected].

RI Framework Frequently Asked Questions

Disclaimer: ©Zenith CW Pty Ltd ABN 20 639 121 403 (Chant West), Authorised Representative of Zenith Investment Partners Pty Ltd ABN 27 103 132 672, AFSL 226872 under AFS Representative Number 1280401, 2023. This website is only intended for use by Australian residents and is subject to use in accordance with Chant West’s Terms of Use and should be read with Chant West’s Financial Services Guide. Products, reports, ratings (Information) are based on data which may be sourced from a third party and may not contain all the information required to evaluate the nominated product providers, you are responsible for obtaining further information as required. To the extent that any Information provided is advice, it is General Advice (s766B Corporations Act). Individuals should seek their own independent financial advice and consider the appropriateness of any financial product in light of their own circumstances and needs before making any investment decision. Chant West has not taken into account the objectives, financial situation or needs of any specific person who may access or use the Information provided including target markets of financial products, where applicable. It is not a specific recommendation to purchase, sell or hold any product(s) and is subject to change at any time without prior notice. Individuals should consider the appropriateness of any advice in light of their own objectives, financial situations or needs and should obtain a copy of and consider any relevant PDS or offer document before making any decision. Information is provided in good faith and is believed to be accurate, however, no representation, warranty or undertaking is provided in relation to the accuracy or completeness of the Information. Information provided is subject to copyright and may not be reproduced, modified or distributed without the consent of the copyright owner. Except for any liability which cannot be excluded, Chant West does not accept any liability whether direct or indirect, arising from use of the Information. Past performance is not an indication of future performance. Chant West ratings and research are prepared by Chant West and are not connected in any way to research and ratings prepared by any of our related entities.