Despite two consecutive months of sliding share markets, the median growth superannuation fund (61 to 80% in growth assets) managed to avoid a loss over the March quarter, posting a zero return. The return for the first three quarters of the financial year remains at a solid 5.5%.

Recent months have seen volatility return to global share markets, sparked by investor concerns over the prospect of rising inflation, rising interest rates and the potential consequences of US-China trade sanctions. Hedged international shares were down 2.2% over the quarter, but a lower Australian dollar (which fell against all major currencies) meant that there was actually a small gain of 0.8% in unhedged terms. On average, growth funds currently have about 70% of their international shares exposure unhedged so they benefited greatly from currency movements over the quarter.

Australian shares slid 3.8% over the quarter, while listed property fell more sharply, with Australian and global REITs retreating 6.2% and 5.3%, respectively.

Chant West senior investment research manager, Mano Mohankumar says: “The March quarter provided another great example of the benefits of diversification. Most listed share and property markets fell, but growth funds typically only have about 55% of their members’ money invested in these sectors. By diversifying across other sectors such as unlisted infrastructure, unlisted property, bonds and cash, which all rose, they managed to smooth out the bumps and produce a flat return for the quarter.

“Funds have had a great run in recent years, with the past six calendar years all producing positive returns averaging over 10%. This is not normal. The typical long-term return objective for growth funds is in the 5.5% to 6.5% range, so even if the June quarter also turns out to be flat the financial year return would still be in that range.

“Volatility can be unsettling, especially if fund members start to take notice of scary media reports. The worst thing they can do in these times is to have a knee-jerk response and switch their super around. Moving into something more conservative may seem natural, but all you’re doing is crystallising losses and leaving yourself with the decision of when to switch back again for more growth. If you’re in the right investment option to start with, the best thing to do is to stay there.”

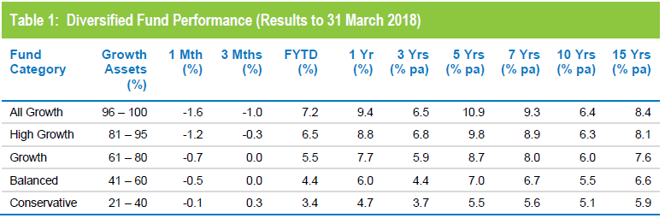

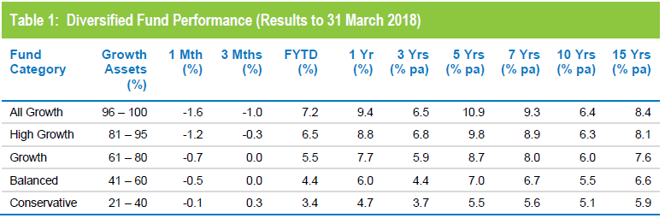

Table 1 compares the median performance for each category in Chant West’s Multi-Manager Survey, ranging from All Growth to Conservative. Over five, seven and fifteen years, all risk categories have met their typical long-term return objectives, which range from CPI + 2% for Conservative funds to CPI + 5% for All Growth. Even the ten year returns, which have been weighed down longest by the GFC effect, have improved to the point where only the All Growth and High Growth categories are short of their return objectives.

Note: Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions.

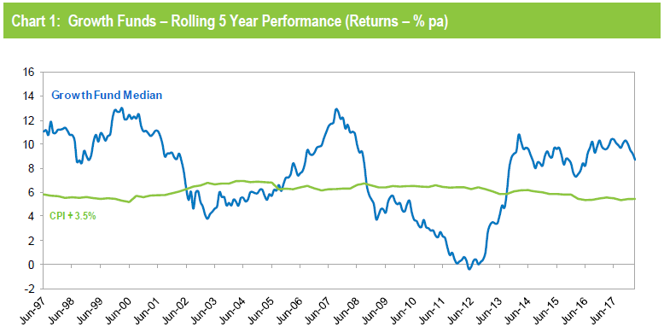

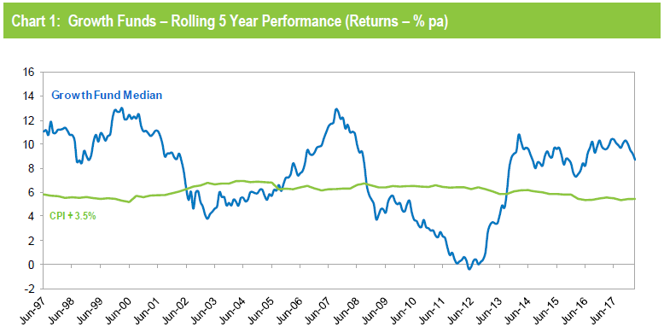

Chart 1 compares the performance since July 1992 – the start of compulsory superannuation – of the Growth category median with the typical return objective for that category (CPI plus 3.5% per annum after investment fees and tax over rolling five year periods). The healthy returns in recent years, and with the GFC period now out of the calculation, have seen the five year performance tracking well above that CPI plus 3.5% target.

Source: Chant West

Note: The CPI figure for the March quarter is an estimate.

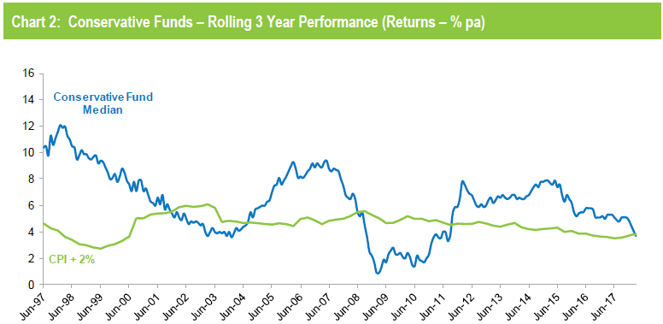

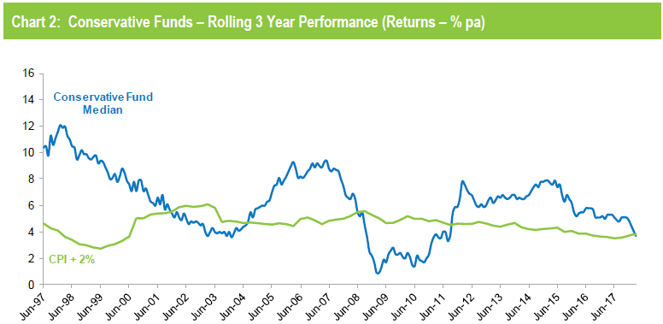

Chart 2 compares the performance of the lower risk Conservative category (21 to 40% growth assets) median with its typical objective of CPI plus 2% per annum over rolling three year periods. It shows that, after exceeding that objective for most of the post-GFC period, they have now fallen fractionally behind. This is because traditional bonds and cash, which form a significant part of their portfolios, have delivered relatively low returns in recent years.

Note: The CPI figure for the March quarter is an estimate.

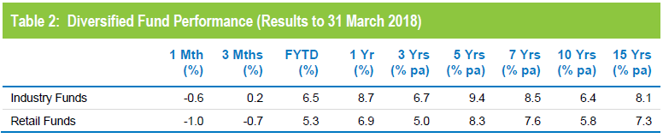

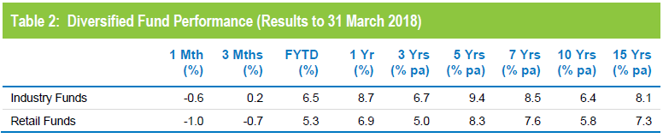

Industry funds ahead the quarter – and the longer term

Industry funds outperformed retail funds over the March quarter, returning 0.2% versus -0.7%, and remain ahead over the financial year to date, at 6.5% versus 5.3%. Industry funds also continue to hold the advantage over the medium and longer term, ahead by between 0.6% and 1.8% per annum, as shown in Table 2.

Source: Chant West

Note: Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions.