Super funds have posted a third consecutive positive month, with the median growth fund (61 to 80% allocation to growth assets) gaining 2.3% in May. That takes the return for the first eleven months of the financial year to 4.0%, raising the prospect of a small positive annual return come the end of June.

The strong performance in May was mainly the result of improving share markets at home and overseas. Australian shares were up 3.1% and hedged international shares rose 1.7% but, due to the depreciation of the Australian dollar (down from US$0.76 to US$0.72), this translated into 6% in unhedged terms. Listed property also rose, with Australian and global REITs up 2.7% and 1.5%, respectively.

Chant West director, Warren Chant says: "While May was an excellent month, we've seen much of that gain erased in the first two weeks of June. That's largely because investors are concerned about the outcome of the UK referendum on June 23rd and what the implications will be if Britain does decide to exit the European Union. That uncertainty has spilled over into global share markets, and we estimate that the median growth fund is down 1.8% in June to date. Nevertheless, with only two weeks remaining we're still sitting at about 2% for the 2016 financial year, so a small positive return looks the most likely outcome. If that does occur it will be the seventh consecutive positive year, which is quite remarkable considering the global economic environment has been unsettled for much of that time.

"In May, there was improved economic data out of the US including better than expected GDP growth. That prompted Federal Reserve chair, Janet Yellen, to state that she expects a further interest rate hike in the coming months. In the Eurozone, share markets benefitted from a weaker euro and there was positive economic data out of Germany. In the UK, worries over a possible 'Brexit' continue to dominate investors' thinking.

"Closer to home, there is ongoing concern over the pace of growth of the Chinese economy. Meanwhile, back in Australia, we saw better than expected GDP growth over the March quarter which resulted in the RBA keeping the official cash rate on hold at an all-time low of 1.75%. However, a further cut this year remains a real possibility."

Table 1 shows the median performance for each category in Chant West's multi-manager survey, ranging from All Growth to Conservative. Over three, five and seven years, all risk categories have met their typical long-term return objectives, which range from CPI + 2% for Conservative funds to CPI + 5% for All Growth. However, the GFC continues to weigh down longer-term returns. Over ten years the higher risk categories failed to achieve their objectives, but over 15 years the Growth, Balanced and Conservative funds did, while All Growth and High Growth fell slightly short having been hardest hit during the GFC.

Source: Chant West

Notes: Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions

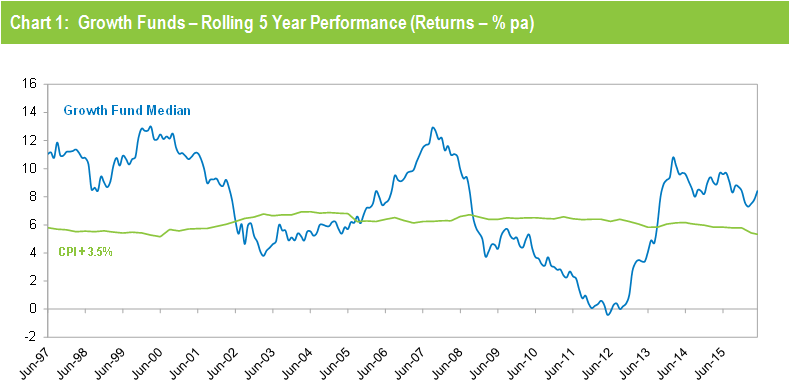

Chart 1 compares the performance since July 1992 – the start of compulsory superannuation – of the Growth category median with the typical return objective for that category (CPI plus 3.5% per annum after investment fees and tax over rolling five year periods). The healthy returns in recent years, combined with the GFC period having worked its way out of the calculation, have seen the five year return continue to track well above that CPI plus 3.5% target.

Source: Chant West

Note: The CPI figures for April and May 2016 are estimates.

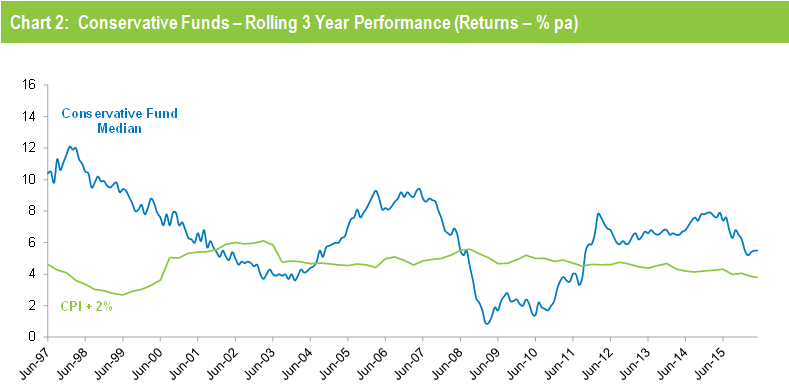

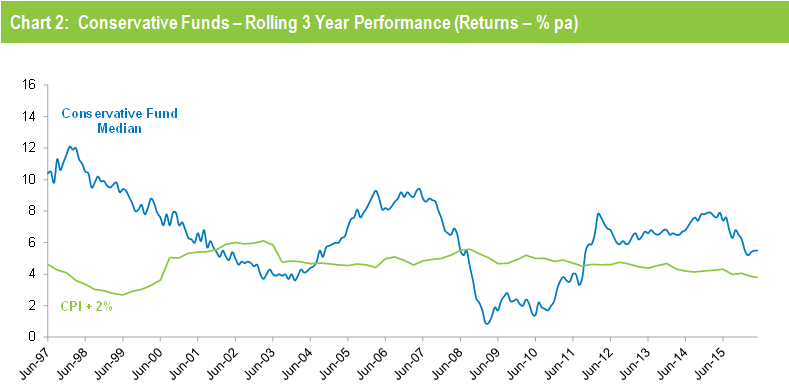

Chart 2 compares the performance of the lower risk Conservative category (21 to 40% growth assets) median with its typical objective of CPI plus 2% per annum over rolling three year periods. It shows that Conservative funds have also exceeded their objective in recent years.

Source: Chant West

Note: The CPI figures for April and May 2016 are estimates.

Retail funds finish ahead in May

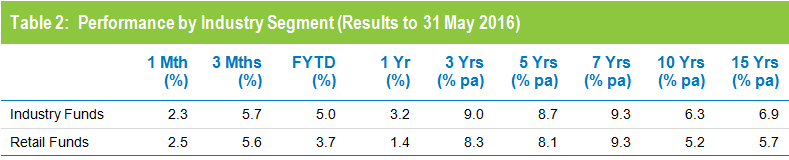

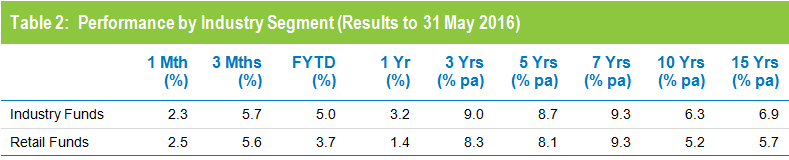

Retail funds outperformed industry funds slightly in May, returning 2.5% versus 2.3%. However, industry funds continue to hold the advantage over the longer term, having returned 6.9% per annum against 5.7% for retail funds over the 15 years to May 2016, as shown in Table 2.

Source: Chant West

Note: Performance is shown net of investment fees and tax. It does not include administration fees or adviser commissions.