Can defence investments align with ESG principles? With defence-focused ETFs managing $A26 billion globally, many from UN-backed responsible investment signatories, this question sparks debate. Explore the complexities of ESG in defence, ethical dilemmas, and how advisers can navigate this challenging landscape. Dive into the nuances shaping today's investment decisions.

In an era of increased geopolitical instability and rising defence budgets, several fund managers around the world have recently launched ETFs focusing on the defence sector. As of 31 October 2024, at least 15 different ETFs managing approximately $A26 billion are trading across global exchanges. While it’s logical that some investors are interested in implementing a hedge against geopolitical turmoil, what’s interesting is not so much investor appetite, but the origins of these ETFs.

Looking at the issuers, the majority (by asset value) are current signatories of the Principles for Responsible Investment, which is backed by the United Nations. At first glance, this seems incongruous. How is selling weapons ‘responsible’, and what should it mean when these same managers are often running ESG and/or sustainability themed funds? Let’s take a look into the finer details and how advisers should interpret this.

Moral minefields - understanding RI boundaries

In November 2023, the UK government released a statement committing to protect its defence companies from “ESG investors” that are “trying to immorally defund British defence”. Similar calls in Europe now sees both governments taking steps to facilitate private investment in the defence sector by emphasising its central role in relation to national security, protection of civil liberties and establishing peace. Locally, the Australian government has indicated it will identify and assess options to partner with private capital to invest in small and medium-sized enterprises in Australia that are developing defence capabilities to ‘keep the peace in our region’.

While these calls aim to ensure security amid growing global ESG regulations, a lack of nuance complicates matters. Responsible investment isn’t binary, it represents a spectrum of different approaches. For example, the Responsible Investment Association Australasia uses the following approach to delineate different strategies, most of which can be blended according to preferences.

Source: Responsible Investment Association Australasia, 2024

It is important to note that being 'responsible' does not necessarily equate to being 'ethical' (often achieved through exclusionary screens), nor is being ethical the same as incorporating ESG considerations into an investment process. While these approaches can be combined to achieve certain outcomes, they are distinct concepts. Depending on how fund managers design their strategies, different elements can be utilised within a broader 'responsible' framework.

Investors should consider ESG in defence

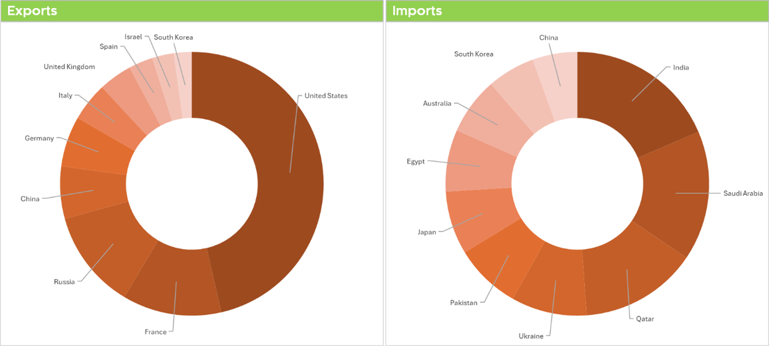

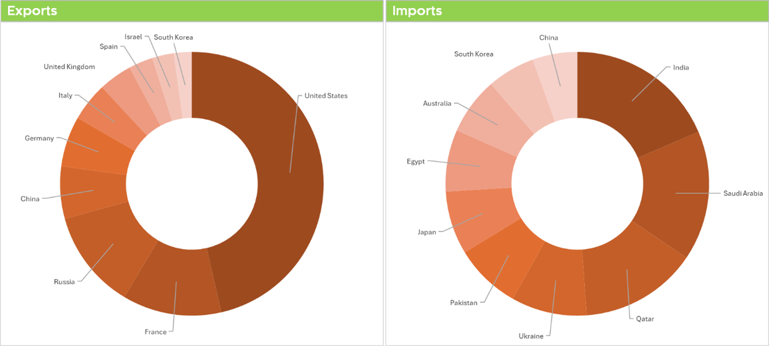

While the rise in regional conflicts has spurred investment in defence-related activities due to increased security challenges, ESG factors still have a role to play for investors. Data from the Stockholm International Peace Research Institute indicated that global military spending increased by 7% to US$2.43 trillion in 2023, with the USA and countries in western Europe accounting for 72% of all arms exports. So investable companies involved on both sides of the import/export chain should be examined.

Top ten: volume of armaments imports and exports 2019-2023

Source: Stockholm International Peace Research Institute (SIPRI), 2024

Put simply, ESG integration focuses on assessing environmental, social and governance factors into traditional investment decision-making and assesses the financial significance of these factors. While the current geopolitical landscape is driving a re-assessment of the defence sector, it’s important for investors to understand the potential for material ESG issues in defence companies which pose high levels of regulatory, financial, legal and reputational risks. These can include human rights violations, political instability, corruption, environmental and health consequences, land contamination and high levels of carbon emissions. The complexity of these issues poses unique challenges for companies with operations within, or exposure to, conflict-affected areas.

Like it or not, even the best-intentioned investors probably have some exposure to the defence sector given its broad nature of supply chains and activities. Companies across information technology, communication services, and industrials may also carry risk if their products and services are used to contribute to harm, directly or indirectly, in conflict zones. At the very least, investors can be indirectly exposed through government bonds from countries involved in arms exports such as the US, the world’s largest arms exporter. It’s critical that investing in defence be done through an ESG lens given the risks involved.

ESG can highlight risks, but that doesn’t mean it’s moral

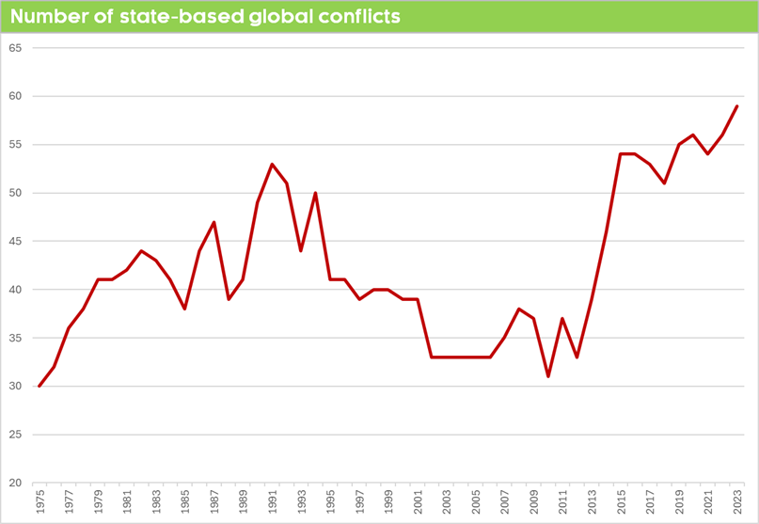

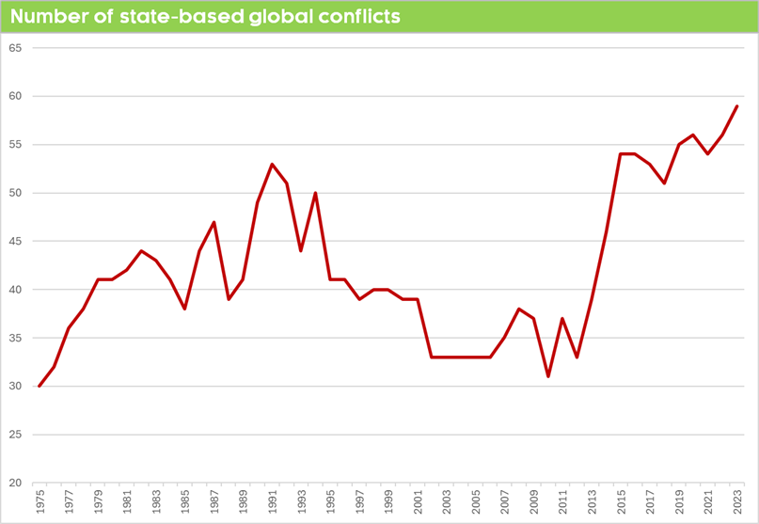

The sale of armaments raises complex moral and ethical questions. We live in an era characterised by the highest number of state-based armed conflicts and associated forcible displacement of people since 1945. Clearly, the human toll associated with armaments is immense.

Source: Uppsala Conflict Data Program, 2023

For investors choosing to exclude the defence sector, this should be viewed as a moral choice, not necessarily an ESG decision. Just as pure ethical investing can be done based on limiting investing in areas based on moral objections irrespective of financial considerations, ESG on its own has no moral filter. Responsible investment strategies can, and usually are, blended in a way where ESG considerations are combined with ethical screening, but they don’t have to. In this light, responsible investment can include defence, but probably only if we are excluding ethical considerations.

Ultimately, we need to remember that responsible investment is nuanced. The debate on the ethics of investing in arms is a conversation that needs to be had with your clients when considering their risk tolerance and personal beliefs. Wars are not just fought by aggressors. What about the security for defenders? What about the fact that arms used to defend are also used to attack? Ethical decisions are rarely binary and clear cut. Rather, ethical decisions on exposure to arms are likely better served by asking ‘when’ and ‘under what circumstances’ it might be appropriate.

Violence is never easy to justify. It cannot be limited simply to saying that the end justifies the means. There have been many times in history where it has been deemed that force must be met with force. Other views are that only when the use of force is just, should it be used as a solution. But which means are justified by which ends?

For investors, we think there is a case for assessing investment in defence using ESG as a lens. We have examined the concept of single versus double materiality previously. In essence, single materiality (via ESG) looks at the world’s impact on a company, but double materiality addresses a company’s impact on the world.

Within this view, ESG alone has no moral compass. Whether it’s moral to profit from defence is an entirely different question and a view that’s unique to the individual.