On May 24, Chant West will present its fifth annual awards at a black-tie function at the Ivy Ballroom, Sydney. The awards recognise the cream of Australia's superannuation and pension funds.

On May 24, Chant West will present its fifth annual awards at a black-tie function at the Ivy Ballroom, Sydney. The awards recognise the cream of Australia's superannuation and pension funds.

The 12 award categories are:

- Super Fund of the Year

- Pension Fund of the Year

- Specialist Fund of the Year

- Corporate Solutions Fund of the Year

- Advised Product of the Year

- Best Fund: Investments

|

- Best Fund: Member Services

- Best Fund: Insurance

- Best Fund: Innovation

- Best Fund: Integrity

- Best Fund: Longevity Product

- Best Fund: Advice Services

|

Chant West director, Warren Chant, says: "As always, our aim with these awards is to help lift standards across the board. We do that by highlighting what the finalists – and especially the winners – have done to stand out from their peers. There are a lot of good funds out there but nobody can be the best at everything. What we do is shine a light on best practice in key areas, giving every fund something to aspire to.

"This year we've introduced a new award category, which is Best Fund: Advice Services, and there's a good reason for that. Increasingly, it's the advice that members receive that enables them to get the greatest value from their fund – especially as they approach retirement. Timely advice, delivered in a way that they can relate to, helps people make good decisions and take appropriate actions at critical stages in their working lives.

"So that's one of the themes we'll be looking at in this year's awards. What strategies are the best funds using to get a better understanding of their members as they approach retirement? What are they doing to inform and 'nudge' those members towards making good decisions? What information are they providing, what advice are they making available and how is that advice being delivered?

"Allied to this, of course, is product development. There's a huge focus at the moment on designing retirement income streams that take into account not only investment risk but also longevity risk. It's all about helping people to receive an income that's sufficient for their needs without running down all their capital prematurely. There's been a lot of good work done in this area, and we'll be recognising that in the awards.

"Investment is always important, because the returns that members receive will help shape their retirement nest eggs and ultimately their retirement incomes. This year, we'll be highlighting the role that unlisted assets have played – and continue to play – in delivering superior returns.

"Non-profit funds, in particular, now have a long track record of investing in unlisted property, infrastructure and private equity and their members have benefited from those investments. Retail funds have done more in recent years, but not nearly to the same extent. We know that management costs for these sectors is higher than for conventional assets, but those higher costs have been more than justified by the results. With ASIC's RG 97 coming into full force later this year, requiring more complete disclosure including indirect costs, there is a temptation for funds to scale back their allocations to unlisted assets. We hope that doesn’t happen."

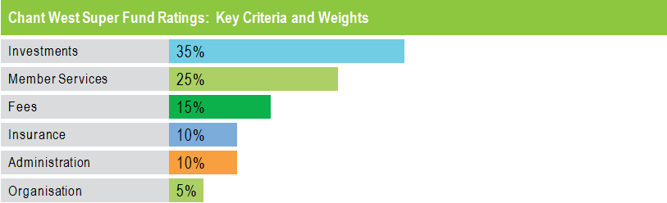

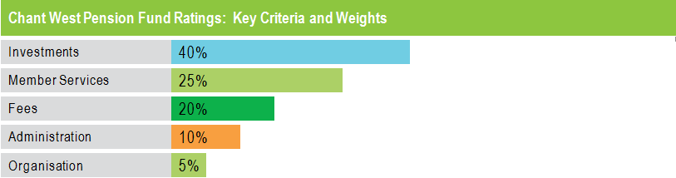

The main criteria Chant West uses for rating funds are shown in the table below. As in previous years, the winner of our premier awards, Super Fund of the Year and Pension Fund of the Year, will have to show strength across the board, but especially in the key areas of Investments and Member Services, which carry the highest weighting in the scoring process.

More information about the awards function is available at www.chantwestawards.com.au.