Ask any group of people about ESG and you are likely to unleash a torrent of answers. Much of this comprises a revolving argument on whether or not ESG is ‘good’, creates value, or is actually about sustainability. And like most debates, the position depends largely on where you stand and which direction you are facing.

Ask any group of people about ESG and you are likely to unleash a torrent of answers. Much of this comprises a revolving argument on whether or not ESG is ‘good’, creates value, or is actually about sustainability. And like most debates, the position depends largely on where you stand and which direction you are facing.

ESG as a concept is challenging due to two main factors: firstly, its wide scope. While conceptually the pillars of environmental, social and governance issues sound straightforward, the number of themes raised can be daunting, with dozens of issues and challenges in play. In addition, often the pursuit of these various societal and planetary challenges can be conflicting in nature. The differences in the perceived level of materiality on individual issues adds further noise to the outcomes.

Secondly, trying to capture and measure these issues is complex. Differences in methodologies between market participants means that unlike more traditional financial measures, non-financial analysis on ESG issues typically means low correlation of results. This is very much at odds with longer running measures like credit quality, which tends to have a high correlation between providers due to more uniform methodologies. Further complications arise where even labelling approaches and their utility across asset classes and strategies lacks global cohesion.

This is intensely problematic. As finance professionals, it’s tempting to try and reduce everything to a single number or consistent factor. Given differences in interpretations, ambiguity and subjectivity, what does this mean in the real world? How should advisers unravel a complex morass of definitions, labels and viewpoints?

Double trouble - Is ESG about sustainability?

In its purest form, we see ESG being about the explicit, systematic incorporation of E, S and G issues into analysis and decision making, in order to better identify risks and opportunities. Within this view, ESG has no moral compass or sustainability considerations. At a company level, ESG is simply a way to look inward, examining the issues a company faces that may influence enterprise value.

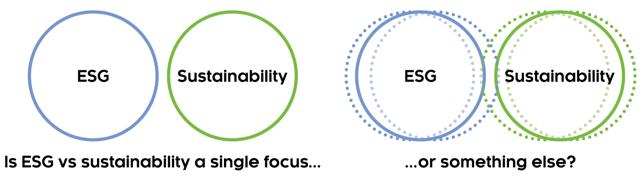

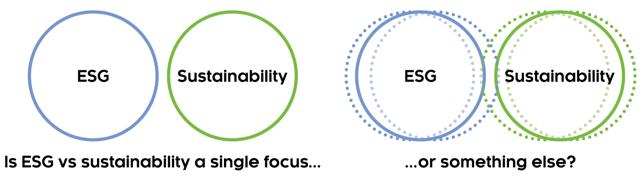

Sustainability, however, reverses this view. It looks outward at how a company identifies and assesses the impact they have on the economy, environment, and people. Put more simply, ESG addresses the world’s impact on a company, while sustainability addresses a company’s impact on the world. ESG and sustainability are best viewed as a loop, a relationship between two distinct things.

This approach is similar to the concept of single versus double materiality in company reporting. Although materiality has itself long been a slippery concept, when introduced in the context of assessing ESG and sustainability, it brings additional nuances.

Single materiality essentially seeks to account for how sustainable factors affect the financial value of a company, whereas double materiality takes into account both that and how the firm affects the environment and society at large. In short, double materiality encompasses both financial and non-financial perspectives, or rather, the recognition that a company can both affect and be affected by ESG issues.

This is of course, a necessary oversimplification, and in the real world, these issues are rarely this clear cut. However, for investors the fundamental question to ask managers is how do they define ESG? Is it inwards, using ESG as a risk/opportunity lens? Or is it outward, examining key impacts and their materiality as a path to greater sustainability?

This is where much of the ‘ESG’ debate occurs. Without recognising the inwards versus outwards aims, confusion ensues. People contest ESG as a lie because it fails to screen out moral transgressions like tobacco or pornography. Simultaneously, others contest ESG fails to result in real world impact and is therefore complicit in harm.

Blurred vision - reconciling different views of ESG

While taking a view that ESG and sustainability should be viewed differently, this doesn’t change the fact they’re merely a lens through which to view an issue. And like all lenses, they can have different focal points and combinations.

At its simplest, ESG provides a single focus, looking inwards at an investment with no regard for sustainability or ethics. In the hands of the user however, this may not necessarily be where it stops. Just as bifocal lenses can bring different things into focus in the one tool, ESG may be progressively tilted towards considering sustainability factors. It’s the understanding of how a fund manager is viewing and/or ultimately using these tools that is the key to understanding where a fund sits in the responsible investment spectrum.

This is a critical point, given that while most fund managers consider ESG to at least some extent in their investment decision making, this does not mean the pursuit of ESG orientated outcomes, or even real-world sustainability, is actually a formalised objective of the fund. Is a fund using ESG a standalone tool, or a stepping stone to something else?

What question is your ESG tool answering?

It has long been said, that if all you have is a hammer, everything looks like a nail. And like all good aphorisms, there’s a lot of truth in it. It’s easy to reach for the tool you have rather than consider the tool you need.

For investors wanting to pursue sustainability, simply reaching for ESG as a tool is unlikely to deliver the results you want. By taking the time to understand a tool’s purpose and the uses to which it can be put before using it, the risk of misalignment between preferences and solutions can be materially reduced.

Ultimately, there are no perfect solutions. At Zenith, we assess hundreds of funds around the globe. And just as each of these pursue different asset classes, strategies and implementation, managers’ terminology around what’s responsible, sustainable or ESG, differ materially.

Clearly, trying to view what’s ‘green’ or ‘good’ using a single lens is ineffective and you risk getting stuck circling around that single point of reference. Rather, by adopting multiple lenses to understand ‘what does fit for purpose look like,’ this can highlight what funds are seeking to achieve. For investors, the starting point when confronted by a tangle of terms is to ask a simple question. Do you want to mitigate ESG risk or pursue investing for sustainability and/or impact? Once investors have answered that question, the adviser’s job becomes more focused on finding the right investment vehicle to help them achieve their goals – after all, that’s what financial advisers do best!