A weak September capped off a disappointing quarter for super funds, with the median growth fund (61 to 80% growth assets) down 1.7% for the first three months of the financial year. However the good news for fund members is that, while listed shares – the main drivers of performance – tumbled more than 6.5%, the broad spread of assets that their funds hold provided a strong measure of protection.

The Australian share market fell 6.5% over the quarter. International shares fared even worse, dropping 7.7% in hedged terms, but this was more than offset by the fall in the Australian dollar. The Australian dollar dropped more than 9%, from US$0.77 to US$0.70, which was enough to turn the 7.7% loss into a small gain of 0.4% in unhedged terms. Listed property was mixed with Australian REITs down 6.5% but global REITs up 1.4%.

Chant West director, Warren Chant says: “The first quarter of the new financial year was disappointing for super fund members, but they should keep in mind that the typical growth fund has just come off six consecutive years of positive returns with a number of funds delivering three straight double digit returns. That sort of performance couldn’t go on forever. And while the global economic outlook remains so uncertain, members should expect more modest returns for the time being coupled with continued volatility.

“The September quarter provided an excellent demonstration of the benefits of diversification. While growth funds feel the pain when listed share markets fall sharply, the fact that they’re also invested in a wide range of other growth and defensive assets, including alternative and unlisted assets, helps cushion the blow. So while Australian and hedged international shares both lost more than 6.5%, the typical growth fund member only suffered a loss of 1.7%.

The trigger for the sharp sell-off in stocks worldwide was increasing concern over the slowing pace of growth in the Chinese economy. Even in the US, where recent economic data has been positive, the market fell significantly due to the negative sentiment surrounding China. Additionally, the US Federal Reserve’s decision to push back its long-awaited interest rate rise created further uncertainty in markets. As a result, investors pulled money out of shares and opted instead for less risky assets.

“The China malaise, which has led to declining energy and metal prices because of dwindling demand, has affected all major markets. The slowdown has a major impact on Australia’s economy given our strong trade links, with the energy and commodities sectors particularly hard hit. Meanwhile the Reserve Bank left the official interest rate at a record low of 2% throughout the quarter, while leaving open the possibility of another rate cut by the end of the year.”

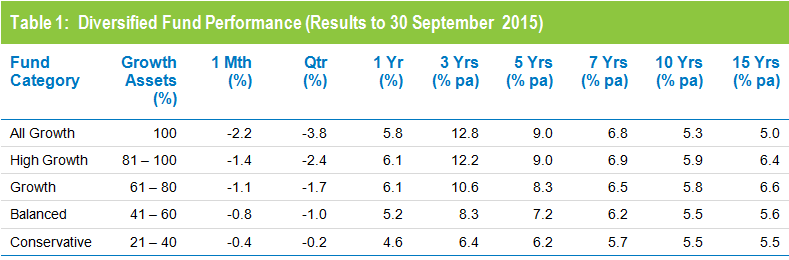

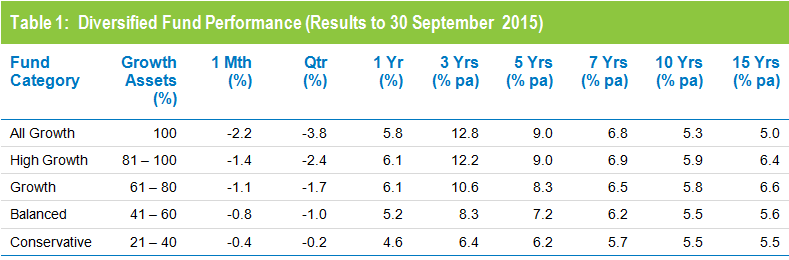

Table 1 shows the median performance for each category in Chant West’s multi-manager survey, ranging from All Growth to Conservative.

Source: Chant West

Note: Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions.

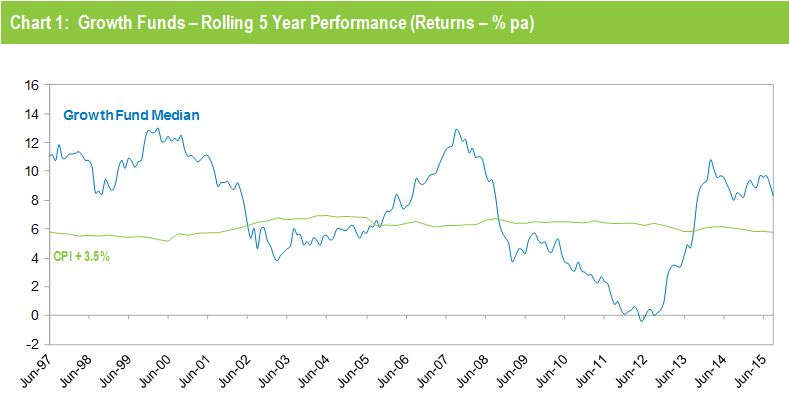

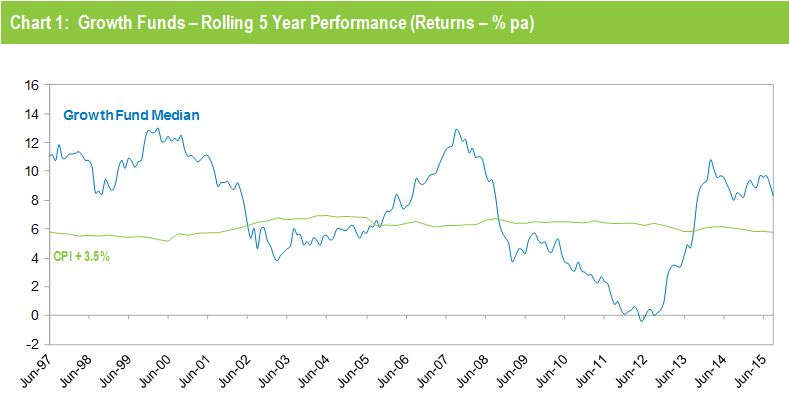

Chart 1 compares the performance since July 1992 – the start of compulsory superannuation – of the Growth category median with the typical return objective for that category (CPI plus 3.5% per annum after investment fees and tax over rolling five year periods). The strong returns in recent years, combined with the GFC period having worked its way out of the calculation, have seen the five year return rise sharply. For nearly two years it has been tracking well above that CPI plus 3.5% target.

Source: Chant West

Note: The CPI figure for the September 2015 quarter is an estimate.

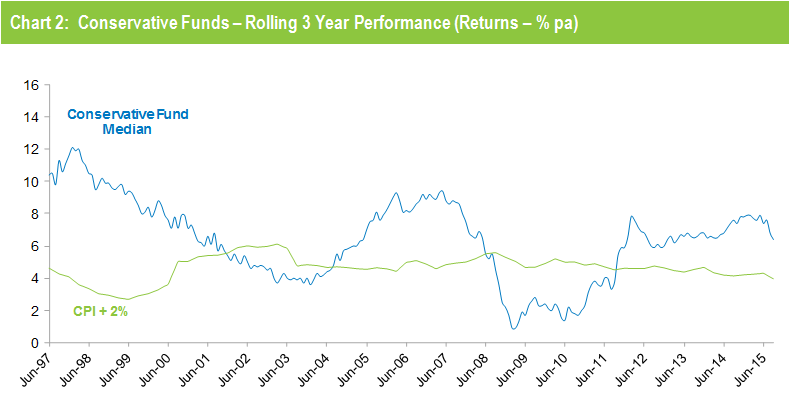

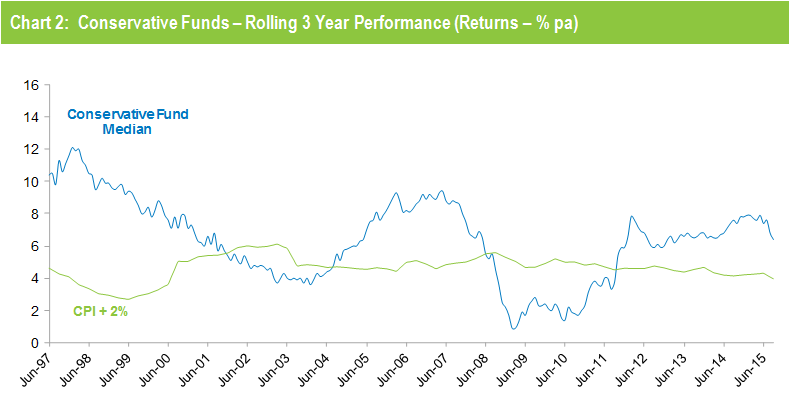

Chart 2 compares the performance of the lower risk Conservative category (21 to 40% growth assets) median with its typical objective of CPI plus 2% per annum over rolling three year periods. It shows that Conservative funds have also exceeded their objective in recent times.

Source: Chant West

Note: The CPI figure for the September 2015 quarter is an estimate.

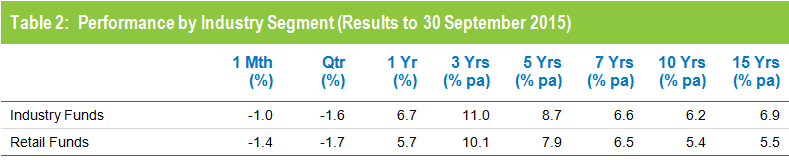

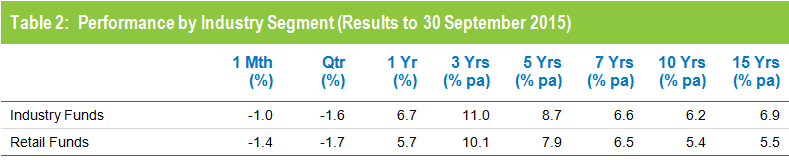

Industry funds broadly in line with retail funds over the quarter

Industry funds and retail funds performed broadly in line with each other over the September quarter, suffering losses of 1.6% and 1.7%, respectively. However, industry funds hold the advantage over the longer term, having returned 6.9% per annum against 5.5% for retail funds over the 15 years to September 2015, as shown in Table 2.

Source: Chant West

Note: Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions.