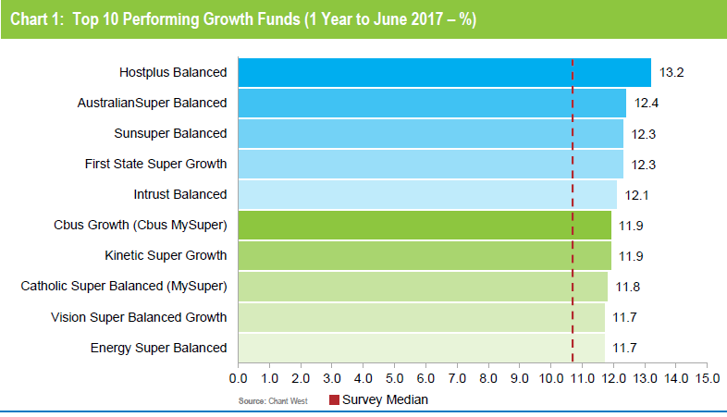

Super funds have delivered a positive return for the eighth consecutive financial year, with the median growth fund up 10.7% for 2016/17. Among the major funds, double digit returns were common. Hostplus took the top spot with 13.2%, and even the worst performing fund in our growth category delivered a respectable 7.4%. Growth funds are those that have a 61 to 80% allocation to growth assets and are the ones in which most Australians are invested

Super funds have delivered a positive return for the eighth consecutive financial year, with the median growth fund up 10.7% for 2016/17. Among the major funds, double digit returns were common. Hostplus took the top spot with 13.2%, and even the worst performing fund in our growth category delivered a respectable 7.4%. Growth funds are those that have a 61 to 80% allocation to growth assets and are the ones in which most Australians are invested.

Chant West director, Warren Chant says: "It's been a really interesting and, in many ways, surprising year because this strong result has been achieved against a backdrop of considerable uncertainty, both political and economic. It just shows how markets – which represent the combined views of thousands of professional investors – are able to cut through the 'noise' and focus on the investment fundamentals.

"The three key stories that dominated the financial pages during the year were the potential fallout from the UK's shock 'Brexit' vote and what that would mean for Europe's future, the equally surprising Donald Trump election victory in the US and, finally, the timing of the US Federal Reserve's moves towards normalising interest rates. On the face of it, those concerns would have been enough to keep share market investors, in particular, very cautious. But instead we've seen share markets reacting optimistically, focusing on the improving global economy, led by the US, and pricing in modest future growth. As a result, international shares surged 18.9% over the year in hedged terms and 14.7% unhedged, while Australian shares also had an excellent year, gaining 13.8%.

"Shares are still the main drivers of performance, but the major funds are well diversified across other asset sectors as well. The better performing funds over the year were those that had higher allocations to listed shares and to unlisted assets generally. It also helped to have a lower exposure to listed property, bonds and cash.

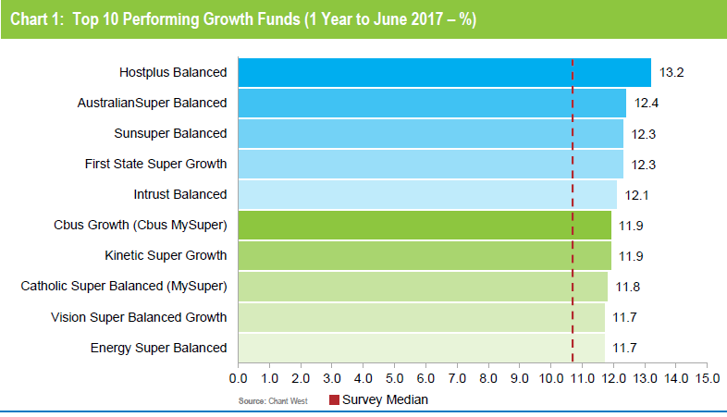

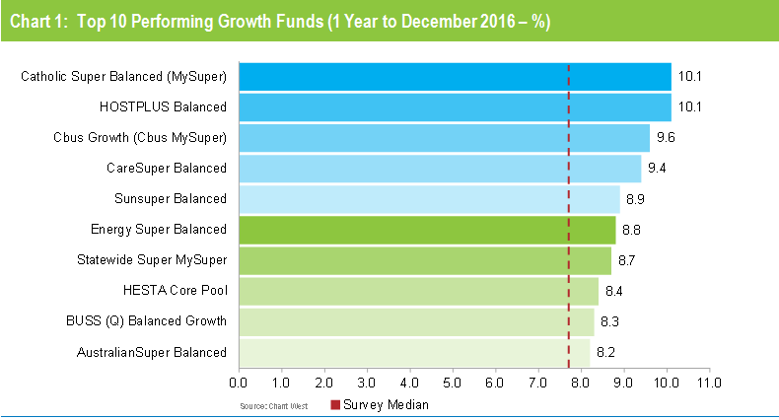

Chart 1 shows the top 10 performing growth options over the year, all of which are non-profit funds.

T

Notes:

1. The top 10 is limited to growth options with assets of $1 billion or more.

2. Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions.

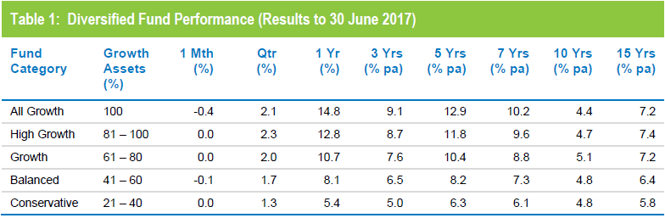

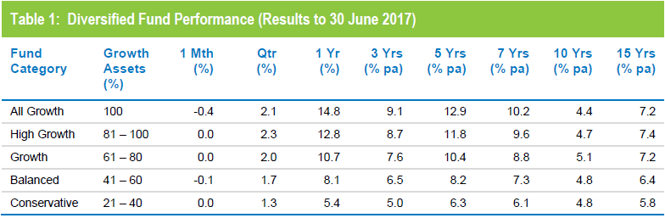

Table 1 compares the median performance for each fund category in Chant West’s Multi-Manager Survey, ranging from All Growth to Conservative. Over one, three, five and seven years, all risk categories have met their typical long-term return objectives, which range from CPI + 2% for Conservative funds to CPI + 5% for All Growth. However, the GFC continues to weigh down the ten year returns with only the Conservative category meeting its objective over this period. Over 15 years, only the All Growth category fell short of its objective having been hardest hit during the GFC.

Source: Chant West

Note: Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions.

Funds still delivering on risk and return targets

While there's no denying that 2016/17 was an excellent one for super funds, Chant encourages members to think long term. "With the growing importance of retirement income streams within super, most people will have money in the super system long after they retire. By all means look at what your fund delivered over the financial year, but what’s really important is to know what its long-term objectives are and whether it's achieving them.

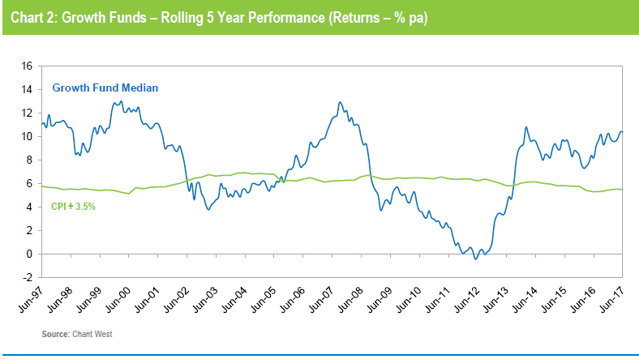

"Funds themselves think long term, and typically the return objective for growth funds is to beat inflation by 3% to 4% per annum over rolling five year periods. We now have data going back 25 years to July 1992, which is when compulsory super was introduced. When we look back over that very long period, we find that the annualised return is 8.3% and the annual CPI increase is 2.5%, so the real return above inflation has averaged 5.8% per annum. So, over the longest period we can measure, funds have well and truly met their return objective.

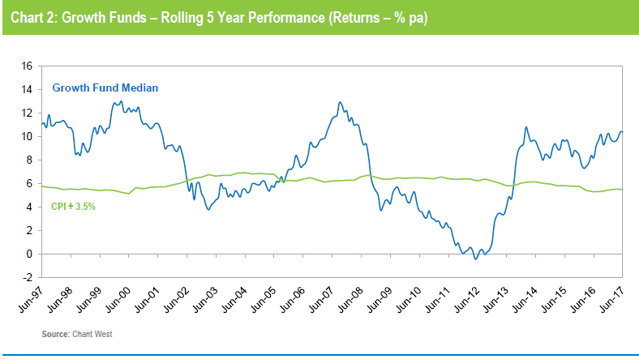

"That's borne out visually in Chart 2, which compares the growth category median with the average return objective for funds in that category (CPI plus 3.5% per annum after investment fees and tax over rolling five year periods).

Note: The CPI figure for the June quarter is an estimate.

"Before the GFC, which took hold in late 2007, the median fund had beaten that target most of the time, but once the GFC years fed into the equation the return dipped below the target line for several years. It’s now more than five years since the GFC ended so, with that period out of the calculation, the five year return has again been tracking above the target line for more than three years.

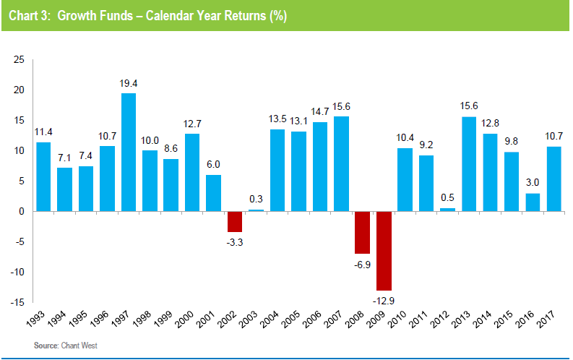

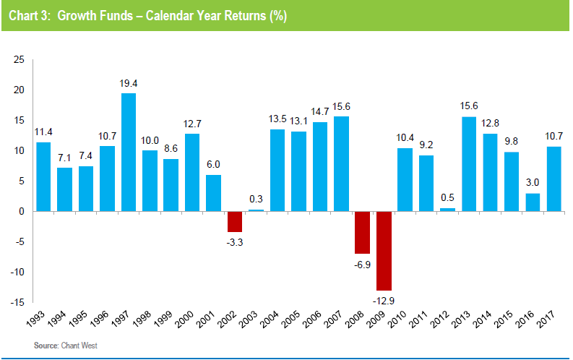

"Returns are important but so is risk, and most funds also set themselves a risk objective. Typically, for a growth fund, this is to post a negative return no more often than once in every five years on average. Chart 3 plots the year by year performance of the median growth fund over the full 25 calendar years since the introduction of compulsory super. In that time, there have been just three years when returns were negative. That averages out to less than one year in eight, so the risk objective has also been met.

Note: Performance is shown net of investment fees and tax. It does not include administration fees or adviser commissions.

"So the message is that over the longest period we can measure Australia’s major super funds have delivered for their members what they set out to do."

The investments that drove the performance

While there are differences between funds' investment strategies, even within the same risk category, most of their performance is driven by what happens in the major investment markets. For growth funds, that is primarily the Australian and international share markets, because those are the sectors where they allocate most of their money.

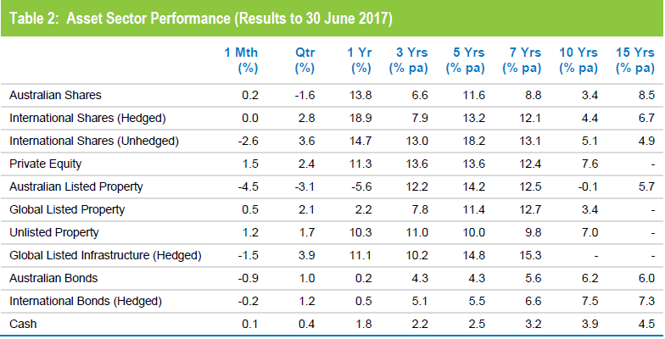

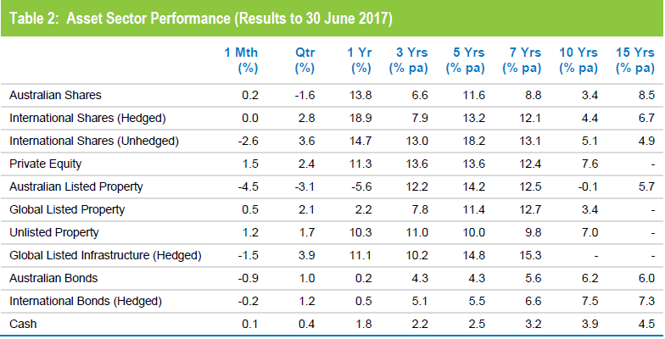

Table 2 shows the performance of all the main asset sectors over different time periods to the end of June 2017. We have used market indices for all sectors other than private equity. For those sectors, for which no indices exist, we have used the returns of a major fund in our survey that are representative of those markets.

Source: Chant West

The key points to note for the 2016/17 financial year are:

Hedged international shares were the strongest performing asset sector, surging 18.9%. However, the appreciation of the Australian dollar pulled this return back to 14.7% in unhedged terms.

Australian shares performed strongly with a return of 13.8%.

After being the strongest performer in 2015/16, Australian listed property was the worst performing sector this year, falling 5.6%. Global listed property fared better, but still returned just 2.2%. Unlisted property, on the other hand, had another solid year, up 10.3%.

Infrastructure also performed well, with global listed infrastructure up 11.1% and unlisted infrastructure delivering returns in the low teens. Private equity also provided a healthy return of 11.3%.

The traditional defensive asset sectors yielded very low returns. Australian and international bonds barely made it into positive territory with returns of 0.2% and 0.5%, respectively, while the return from cash was just 1.8%.

Industry funds ahead of retail funds over the year and longer term

Industry funds outperformed retail funds over the year, returning 11.1% versus 9.7%. Industry funds also hold the advantage over the medium and longer term, ahead by between 0.7% and 1.4% per annum, as shown in Table 3.

Source: Chant West

Note: Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions.

Chart 4 compares the performance of the two segments year by year over the past ten years.

Chant says: "Over the longer term, industry funds have outperformed retail funds because, as a group, they have tended to have lower allocations to listed shares and REITs. They do better, relative to retail funds, when those listed sectors produce low or negative returns. The corollary is that they also tend to have higher allocations to unlisted assets such as private equity, unlisted property and unlisted infrastructure (20% versus 5%), which have performed relatively well for them.

"Over the longer term, the asset allocation policies of industry funds have served them very well. Those allocations to unlisted assets do mean slightly higher investment costs, but those extra costs have been more than justified by the better performance and lower volatility.

"Industry funds have also been more prepared to shift away from their longer-term target asset allocations to take advantage of mispricing or to preserve capital. Overall, those medium-term shifts have had a positive effect on their performance."

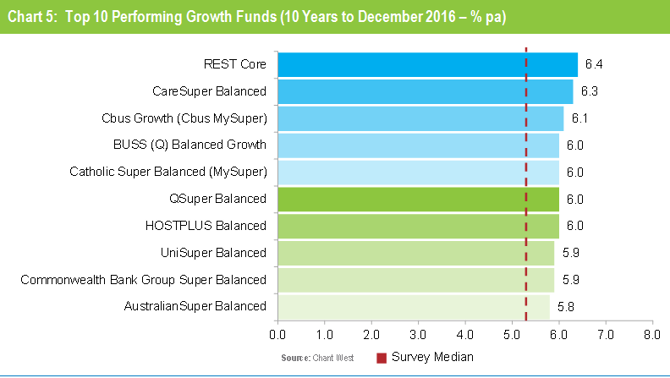

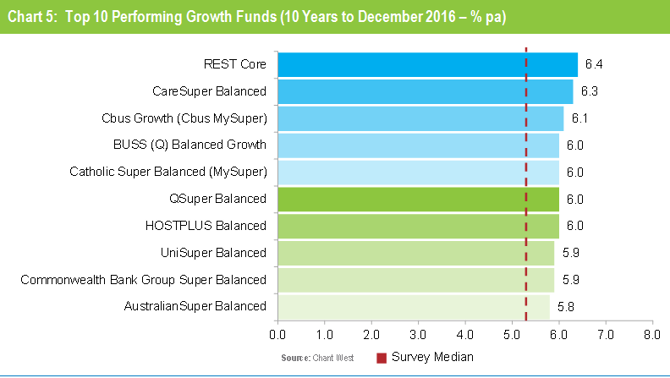

Chart 5 shows the top 10 performing funds over ten years. As has been the case for many years, the list is dominated by industry funds which account for eight of the ten places. The other two places are occupied by QSuper, a non-profit fund formerly reserved for Queensland Government employees that has recently opened its doors to the public, and the stand-alone fund for employees of Commonwealth Bank.

Notes:

1. The top 10 is limited to growth options with assets of $1 billion or more.

2. Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions.