After suffering losses in January and February, super funds bounced back into positive territory in March on the strength of resilient share markets. The median growth fund (61 to 80% in growth assets) was up 1.1% for the month, trimming the decline over the quarter to 2%. So the possibility of a positive 2021/22 result is still very much alive, with the median return sitting at 2.3% over the first nine months of the financial year.

Chant West Senior Investment Research Manager, Mano Mohankumar, says the positive outcome in March came despite the serious concerns that continue to weigh on investment markets – notably the Russia-Ukraine war and the threat of rising inflation and interest rates. “The geopolitical and economic implications of the war are still a major unknown. So far, it has resulted in an energy and commodity price shock that has amplified the surge in inflation. So central banks around the world are faced with a dilemma; either increase the pace of interest rate hikes to combat inflation or hold back on the tightening in an effort to support economic growth. So far, it appears they view inflation as the more pressing issue and in March we saw the US Federal Reserve increase its target rate by 0.25%, with further increases expected through 2022. That pattern is likely to continue in the US and elsewhere unless the outlook for economic growth worsens significantly.

“Against this uncertain background, share markets showed great resilience in March. In particular, the Australian share market has continued its relative outperformance, buoyed by its high weighting to resource companies which have benefited significantly from rising commodity prices. Financials were also key contributors to the strong performance with large gains from the major banks. Over the month, Australian shares surged 6.9%. While international shares didn’t fare as well, they were still up a healthy 3% in hedged terms. However, the sharp appreciation of the Australian dollar over the period (up from US$0.73 to US$0.75 and from €0.64 to €0.68), turned that gain into a small loss of 0.9% in unhedged terms. Bonds continued to suffer as yields rise, with Australian and international bonds losing 3.7% and 2.1%, respectively, over the month.

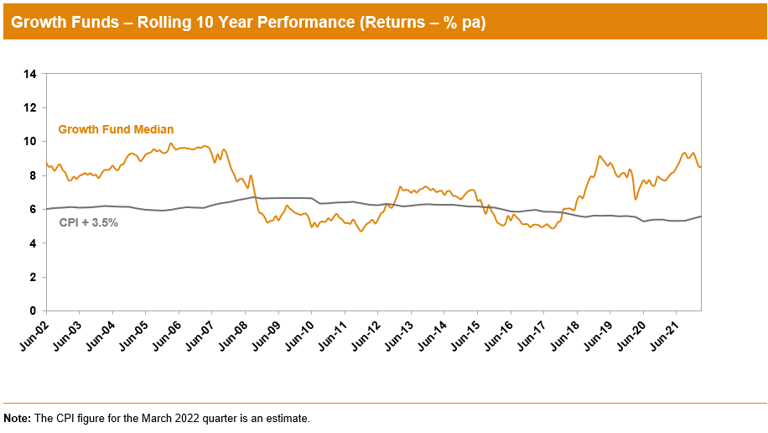

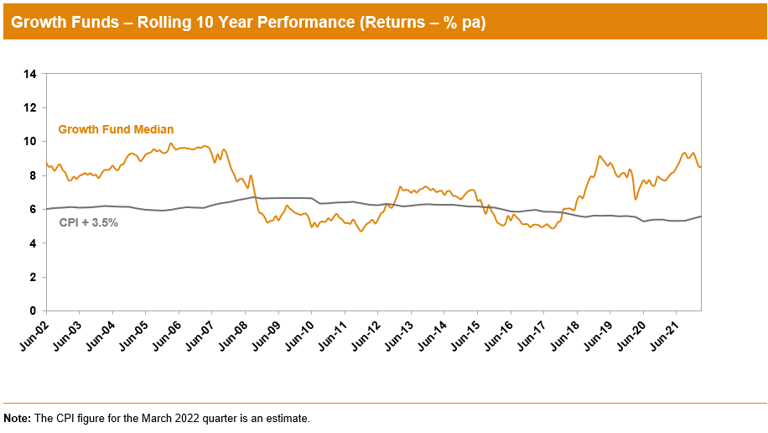

“Clearly, we’re in a very turbulent period and strong investment returns are going to be hard to find. Super fund members need to be reminded that they can’t expect a continuation of the returns we’ve seen over the past decade, when the median growth fund delivered 8.5% per annum. That’s not sustainable and it’s not what these funds are designed to achieve. The typical long-term return objective for growth funds is to beat inflation by 3.5% per annum. That translates to about 5.5% to 6% per annum in absolute terms, which is far more realistic in the current climate.

“Members also need to maintain a long-term focus. That’s the key to ensure you don’t get distracted by short-term noise and make knee-jerk decisions which will hurt your long-term investment prospects. As an example, if you switched from a growth fund to cash or a more conservative option during February, you would have crystallised losses and missed out on the subsequent rebound in March. Attempting to time the market almost invariably results in worse longer-term outcomes than if you sit tight and ride out the ups and downs.”

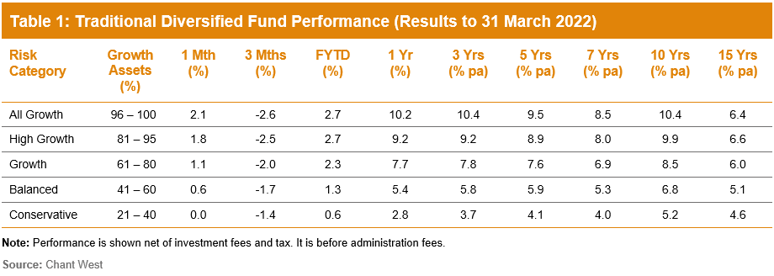

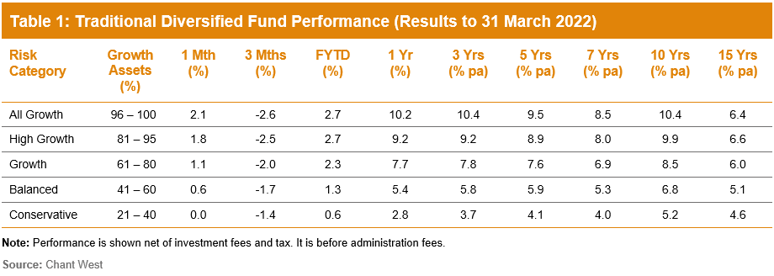

Table 1 compares the median performance for each of the traditional diversified risk categories in Chant West’s Multi-Manager Survey, ranging from All Growth to Conservative. All risk categories have generally met their typical long-term return objectives, which range from CPI + 2% for Conservative funds to CPI + 4.25% for All Growth.

Lifecycle products behaving as expected

Mohankumar says that while the Growth category is still where most people have their super invested, a meaningful number are now in so-called ‘lifecycle’ products. “Most retail funds have adopted a lifecycle design for their MySuper defaults where members are allocated to an age-based option that’s progressively de-risked as that cohort gets older,” he said.

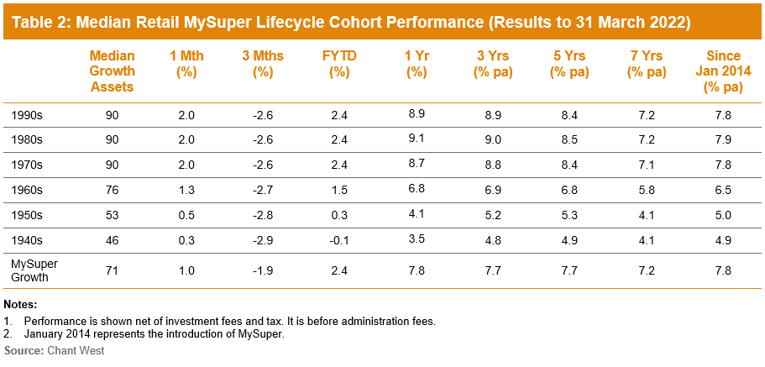

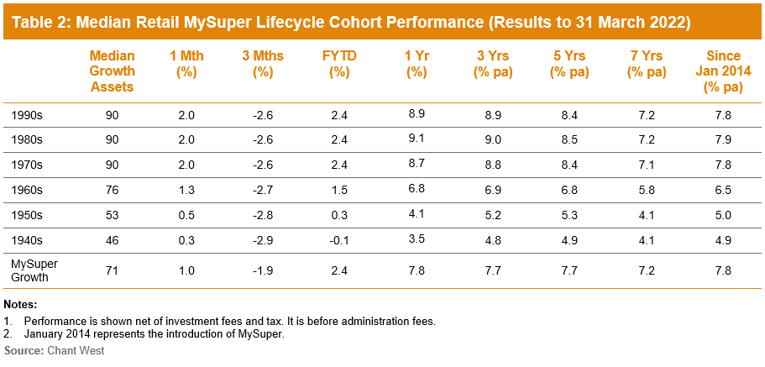

“It’s difficult to make direct comparisons of the performance of these age-based options with the traditional options that are based on a single risk category, and for that reason we report them separately. Table 2 shows the median performance for each of the retail age cohorts, together with their current median allocation to growth assets. For comparison purposes it also includes a row for traditional MySuper Growth options – nearly all of which are not-for-profit funds. Care should be taken when comparing the performance of the retail lifecycle cohorts with the median MySuper Growth option, however, as they’re managed differently so their level of risk varies over time.”

Despite the share market falls in January and February, options that have higher allocations to growth assets have done better over most periods shown. Younger members of retail lifecycle products – those born in the 1970s, 1980s and 1990s – have generally either outperformed or performed in line with the MySuper Growth median over periods longer than three months. However, they’ve done so by taking on significantly more share market risk. On average, these younger cohorts have at least 20% more invested in listed shares and listed real assets than the typical MySuper Growth option.

The 1960s cohort has generally underperformed the median MySuper Growth option. This is partly due to a lower allocation to growth assets up until recently, when lifecycle product providers revised their glide paths to delay the de-risking process until older ages. Another reason for this underperformance is a lower allocation to unlisted assets, which have performed well, and a higher allocation to traditional defensive asset sectors, such as bonds and cash, which have been the weakest performing sectors since the introduction of MySuper.

The oldest cohorts (those born in the 1950s or earlier) are relatively less exposed to growth assets so you would expect them to underperform the MySuper Growth median over longer periods. Capital preservation is more important at those ages, so while they miss out on the full benefit in rising markets, older members in retail lifecycle options are generally better protected in the event of market weakness.

Long-term performance remains above target

MySuper products have only been operating for eight years, so when considering performance it’s important to remember that super is a much longer-term proposition. Since the introduction of compulsory super in 1992, the median growth fund has returned 8.1% p.a. The annual CPI increase over the same period is 2.5%, giving a real return of 5.6% p.a. – well above the typical 3.5% target. Even looking at the past 20 years, which now includes three major share market downturns – the ‘tech wreck’ in 2002–2003, the GFC in 2007–2009 and COVID-19 in 2020 – the median growth fund has returned 7.1% p.a, which is still well ahead of the typical return objective.

The chart below shows that, for the majority of the time, the median growth fund has exceeded its return objective over rolling 10-year periods, which is a commonly used timeframe consistent with the long-term focus of super. The exceptions are two periods between mid-2008 and late-2017, when it fell behind. This is because of the devastating impact of the 16-month GFC period (end-October 2007 to end-February 2009) during which growth funds lost about 26% on average.

International share market returns in this media release are sourced from MSCI. This data is the property of MSCI. No use or distribution without written consent. Data provided “as is” without any warranties. MSCI assumes no liability for or in connection with the data. Product is not sponsored, endorsed, sold or promoted by MSCI. Please see complete MSCI disclaimer.