Super funds are off to a disappointing start in 2016 on the back of sharp falls in share markets worldwide. The median growth fund (61 to 80% allocation to growth assets) retreated 2.3% in January, and has continued to slide further into the red in February.

Australian shares were down 5.4% for the month of January. Hedged international shares also fell 5.4% but the depreciation of the Australian dollar (down 2¢ to US$0.71 over the month) meant that the loss in unhedged terms was smaller at 3.2%. Listed property was mixed, with Australian REITs up 0.9% but global REITs down 3.6%.

Listed shares may be the main driver of performance, but they're by no means the only drivers. Chant West director, Warren Chant says: "Super fund members sometimes panic when they see media reports about share markets falling sharply, but they need to remember that growth funds, which most Australians are invested in, typically only have about 55% of their assets in listed shares and REITs. These funds are diversified across a wide range of other assets as well, including alternative and unlisted assets that are far less volatile. This means that during periods of sharemarket turmoil, they're able to cushion the blow. So while Australian and international share markets are down more than 7% over the first seven weeks of 2016, we estimate the median growth fund’s loss has been limited to just 3%.

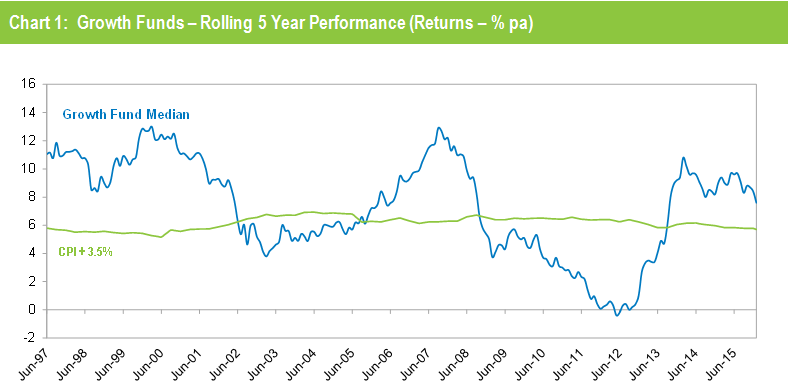

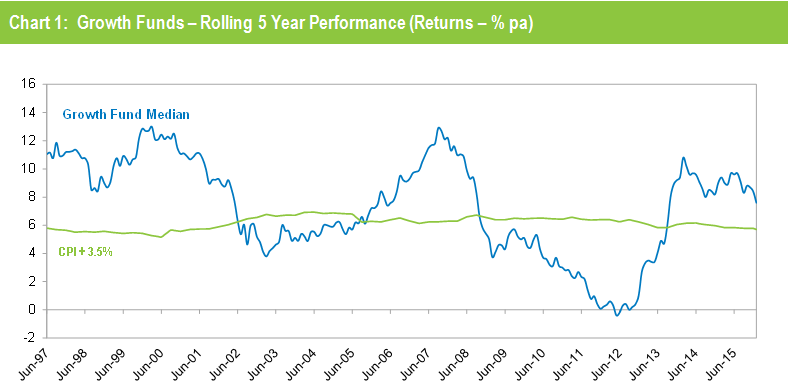

"It's also important to put things in perspective. Growth funds have just come off four consecutive years of positive returns averaging 11% per annum. Now that’s not normal. Funds have had a very good run, but members need to remember that super is a lifetime investment, and there will be good times and bad times along the way. The typical long-term return objective for growth funds is to outperform inflation by 3.5% per annum and funds have been delivering on this promise for a very long time.

"We're in a period of low growth and high volatility and this could last for some time. However, we encourage super fund members to remain patient and not panic. Moving into a more conservative investment option now would not only crystalise your losses but you may miss out on the benefits of any subsequent rebound. Of course, we recognise that older members may have a lower tolerance for seeing their balance go down than people in their 20s or 30s, but then super doesn't necessarily stop when you retire. If you convert your super into a pension to live on, the money will stay in the fund for many more years."

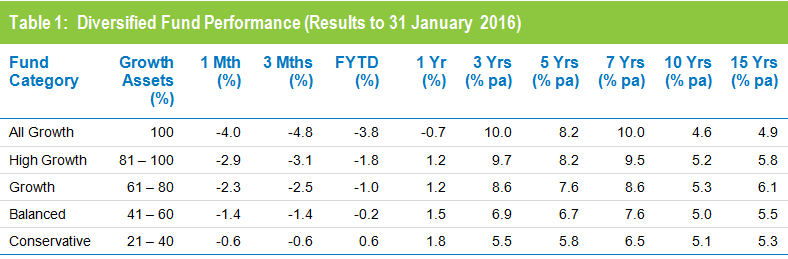

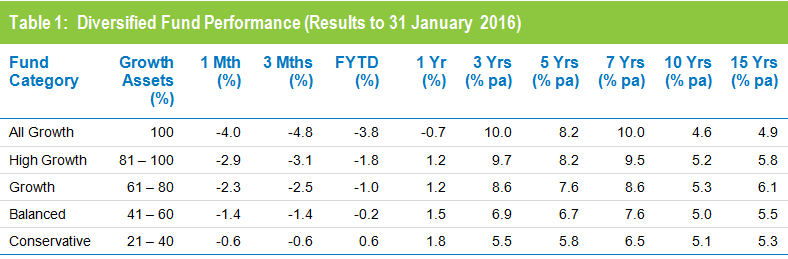

Table 1 shows the median performance for each category in Chant West's multi-manager survey, ranging from All Growth to Conservative. The three and five year returns reflect the strong performance of listed shares and property in recent years, so the more aggressive fund categories, which have a higher proportion invested in those assets, have produced the best performance. The seven year returns have improved significantly as the GFC period has nearly worked its way out of the calculation.

Source: Chant West

Notes: Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions

Chart 1 compares the performance since July 1992 – the start of compulsory superannuation – of the Growth category median with the typical return objective for that category (CPI plus 3.5% per annum after investment fees and tax over rolling five year periods). The healthy returns in recent years, combined with the GFC period having worked its way out of the calculation, have seen the five year return rise sharply. For about two years it has been tracking well above that CPI plus 3.5% target.

Source: Chant West

Note: The CPI figure for January 2016 is an estimate.

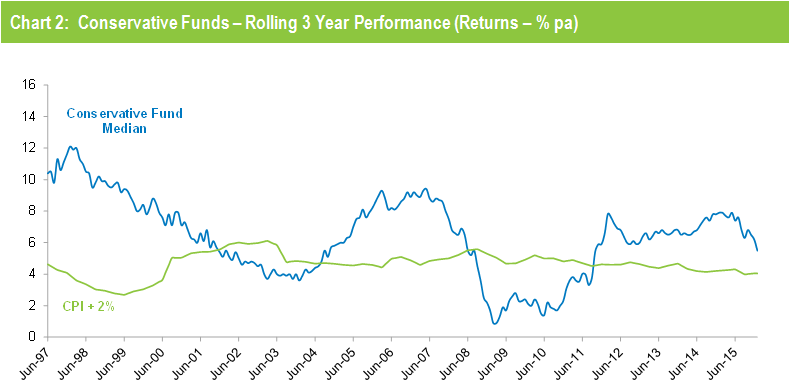

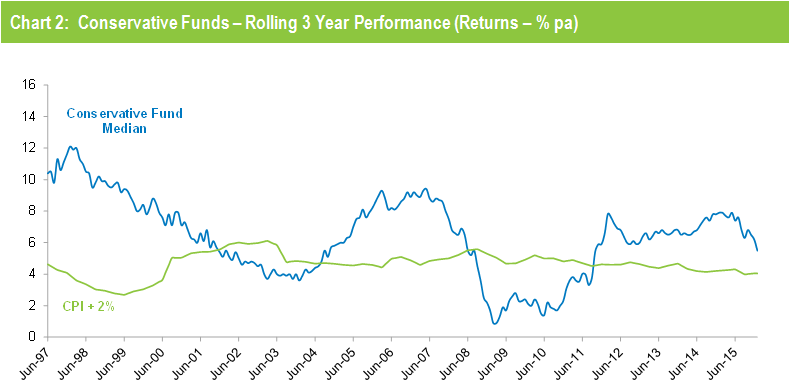

Chart 2 compares the performance of the lower risk Conservative category (21 to 40% growth assets) median with its typical objective of CPI plus 2% per annum over rolling three year periods. It shows that Conservative funds have also exceeded their objective in recent years.

Source: Chant West

Note: The CPI figure for January 2016 is an estimate.

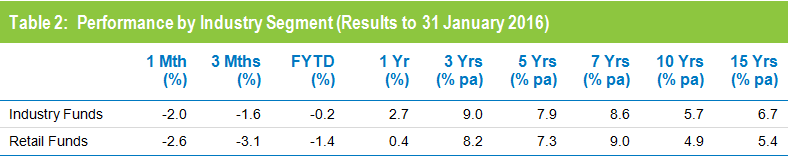

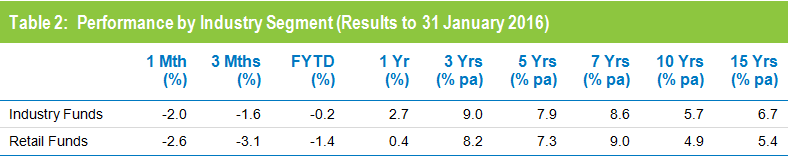

Industry funds ahead of retail funds in January

Industry funds outperformed retail funds in January with a return of -2% versus -2.6%. Industry funds also hold the advantage over the longer term, having returned 6.7% per annum against 5.4% for retail funds over the 15 years to January 2016, as shown in Table 2. Performance over three, five, seven and ten years is closer.

Source: Chant West

Note: Performance is shown net of investment fees and tax. It does not include administration fees or adviser commissions.