After a disappointing start to the year, super funds have posted a second consecutive positive month and are edging closer to a positive financial year result. Following a rise of 1.8% in March, the median growth fund (61 to 80% allocation to growth assets) gained another 1.4% in April. That takes the return over the ten months of the financial year to date to 1.7%.

Australian shares were the main positive contributors, rising 3.3% over the month. Hedged international shares were up 0.8%, but because of the slight depreciation of the Australian dollar (down from US$0.77 to US$0.76) the return in unhedged terms was higher at 2.4%. Listed property was mixed, with Australian REITs up 2.8% but global REITs down 0.7%.

Chant West director, Warren Chant says: "We estimate that the median growth fund is up a little over 1% so far in May, so with only six weeks remaining we're now sitting at about 3% for the financial year to date. That means it's slightly better than an even money bet that we'll see a seventh consecutive positive year.

"It's pretty certain we're not going to see a result as strong as the previous three years (15.6% in 2012/13, 12.8% in 2013/14 and 9.8% in 2014/15), but members shouldn't be too disappointed with anything in positive territory, considering the patchy global economic environment, the volatility we've seen in share markets worldwide and the fact that super funds have had a particularly good run in recent years.

"Data out of the US in April was slightly worse than expected, and with doubts remaining about the strength of the US economic recovery there's growing uncertainty about the timing of any further hikes in the interest rate. In contrast, economic growth indicators in the Eurozone were better than expected. It's a different story in the UK, where investors are uneasy about whether Britain will leave the European Union and, if it does, what the consequences will be.

"Closer to home, there is ongoing concern over the pace of growth of the Chinese economy. Meanwhile, back in Australia, a low inflation figure helped prompt the RBA to lower the cash rate earlier this month to an all-time low of 1.75%, with a further cut this year being a real possibility."

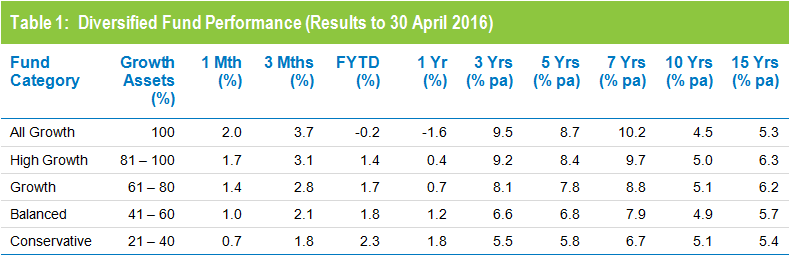

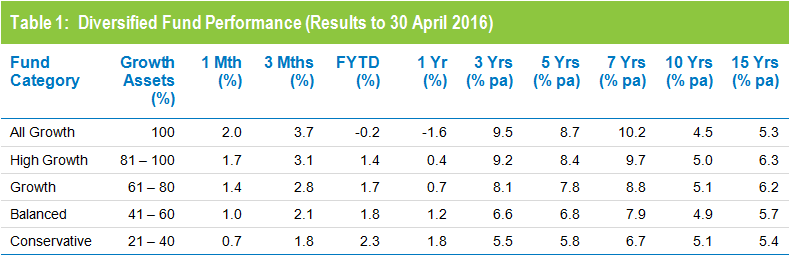

Table 1 shows the median performance for each category in Chant West's multi-manager survey, ranging from All Growth to Conservative. Over three, five and seven years, all risk categories have met their typical long-term return objectives, which range from CPI + 2% for Conservative funds to CPI + 5% for All Growth. However, the GFC continues to weigh down longer-term returns. Over ten years the higher risk categories failed to achieve their objectives, but over 15 years the Growth, Balanced and Conservative funds did, while All Growth and High Growth fell slightly short having been hardest hit during the GFC.

Source: Chant West

Notes: Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions

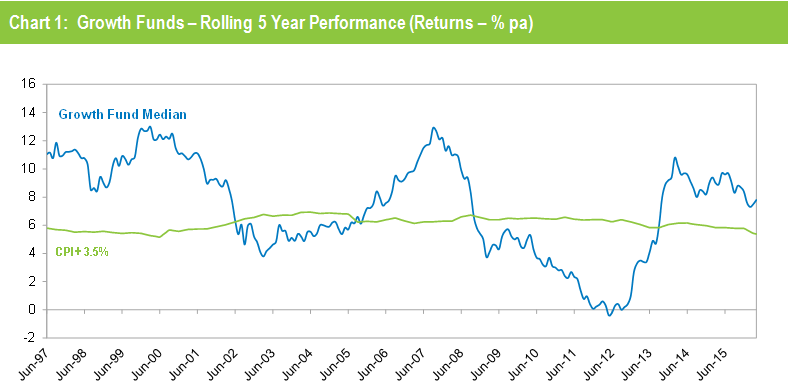

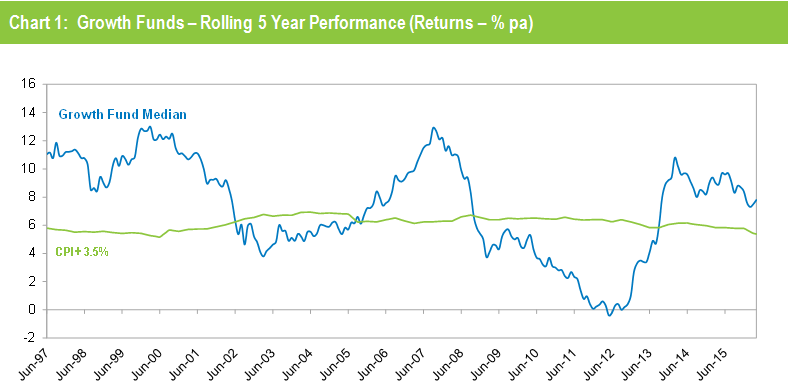

Chart 1 compares the performance since July 1992 – the start of compulsory superannuation – of the Growth category median with the typical return objective for that category (CPI plus 3.5% per annum after investment fees and tax over rolling five year periods). The healthy returns in recent years, combined with the GFC period having worked its way out of the calculation, have seen the five year return continue to track well above that CPI plus 3.5% target.

Source: Chant West

Note: The CPI figure for April 2016 is an estimate.

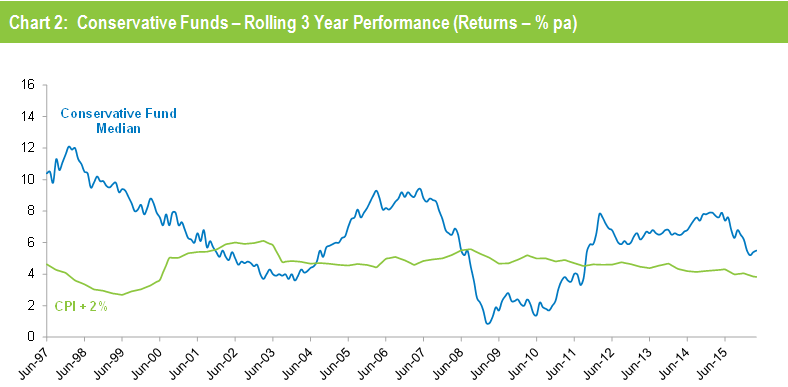

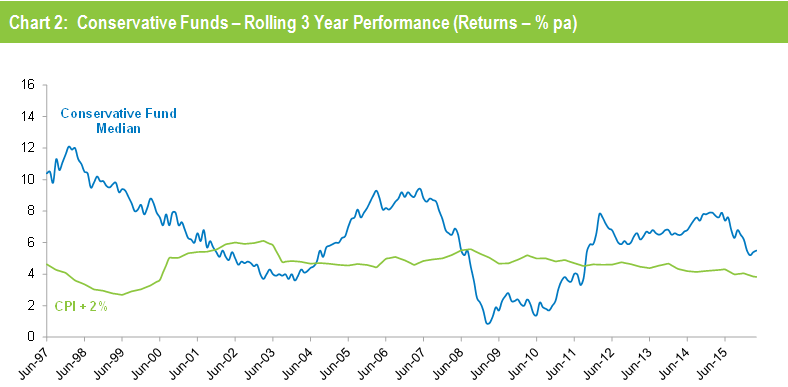

Chart 2 compares the performance of the lower risk Conservative category (21 to 40% growth assets) median with its typical objective of CPI plus 2% per annum over rolling three year periods. It shows that Conservative funds have also exceeded their objective in recent years.

Source: Chant West

Note: The CPI figure for April 2016 is an estimate.

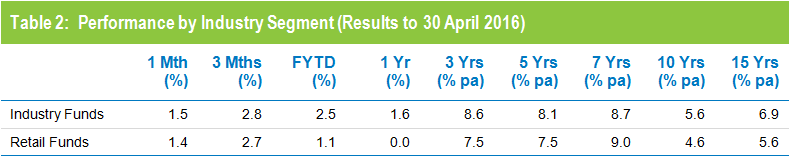

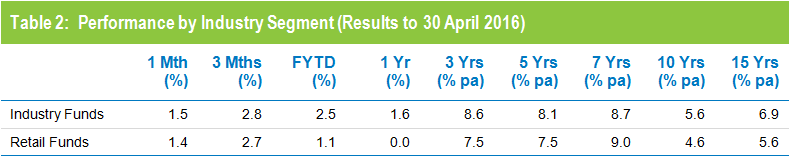

Industry funds just edge retail funds in April

Industry funds and retail funds performed broadly in line with each other in April, returning 1.5% and 1.4% respectively. However, industry funds continue to hold the advantage over the longer term, having returned 6.9% per annum against 5.6% for retail funds over the 15 years to April 2016, as shown in Table 2.

Source: Chant West

Note: Performance is shown net of investment fees and tax. It does not include administration fees or adviser commissions.