Following a solid September quarter, super funds retreated in October in the lead-up to the US election, with the median growth fund (61 to 80% growth assets) down 0.7% for the month. This brought the return for the first ten months of 2016 to 4.1% so, with only six weeks of the year remaining, there is a good chance that funds will deliver a fifth consecutive calendar year return.

Listed share markets, which are the main drivers of growth fund returns, were down in October. Australian shares fell 2.2% while international shares were down 0.6% and 1.4% in hedged and unhedged terms, respectively. Listed property suffered on rising bond yields, with Australian REITs plummeting 7.7% and global REITs retreating 4.5%.

Chant West director, Warren Chant says: "The nervous mood in financial markets continued in October. The most immediate concern was the outcome of the US election, while the future of global interest rates and the consequences of Brexit still prey on investors' minds. We now have clarity on that first issue, of course, with Donald Trump coming away with a shock victory. However, along with his victory comes much policy uncertainty.

"So far, stock markets around the world have, for the most part, taken Trump's victory in their stride. Defying predictions of a major slump, shares fell as the result became clear but then reversed direction and rose strongly. However, bond markets have taken a hit, based on expectations that the Trump administration will follow through on its promises to spend significant amounts on infrastructure and cut taxes. Rising bond yields are generally unfavourable for property and infrastructure, and we have already seen significant falls in the value of REITs and listed infrastructure.

"A statement from the Federal Open Market Committee meeting in early November indicated that the case for a further interest rate hike had strengthened. However, given Trump's election victory, a rate rise in December is by no means a certainty. While this timing issue is dominating market sentiment, far more important will be the pace at which interest rates increase over the next few years and what that will mean for inflation.

"In October, markets in the Eurozone were helped by better than expected quarterly results from several banks. The European Central Bank is likely to decide in December whether to extend its 80 billion euro quantitative easing programme beyond the current deadline of March 2017. Given that growth remains lacklustre, most experts expect the programme to continue. In Britain, Prime Minister Theresa May indicated a tougher stance on Brexit and announced that formal proceedings to remove the UK from the EU would begin by the end of March 2017.

"Closer to home, Trump's victory leaves Australia and China quite vulnerable given their reliance on international trade. Trump has canvassed protectionist policies that, if enacted, have the potential to set off a trade war that could be damaging to both economies."

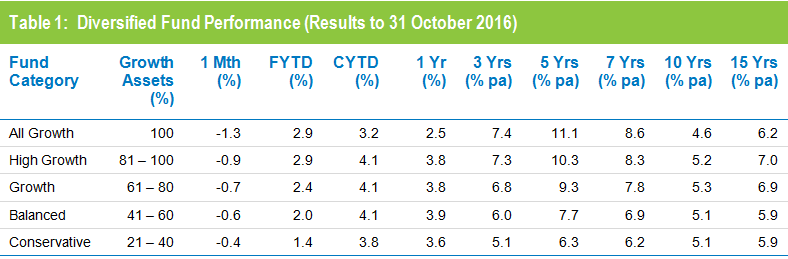

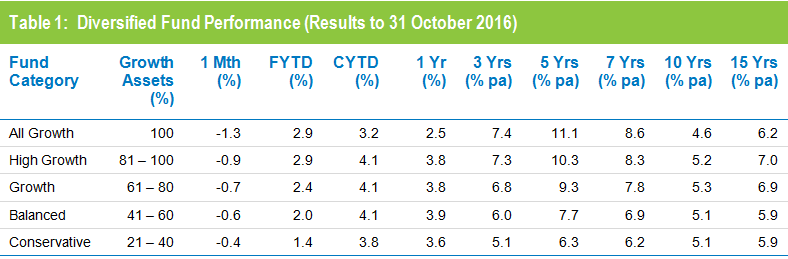

Table 1 shows the median performance for each category in Chant West's Multi-Manager Survey.

Source: Chant West

Notes: Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions.

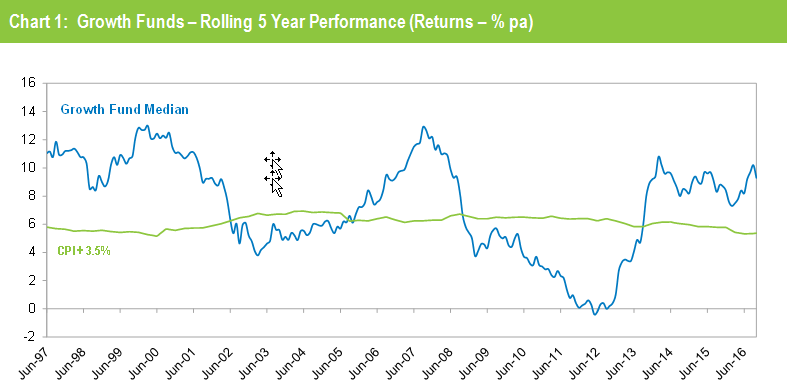

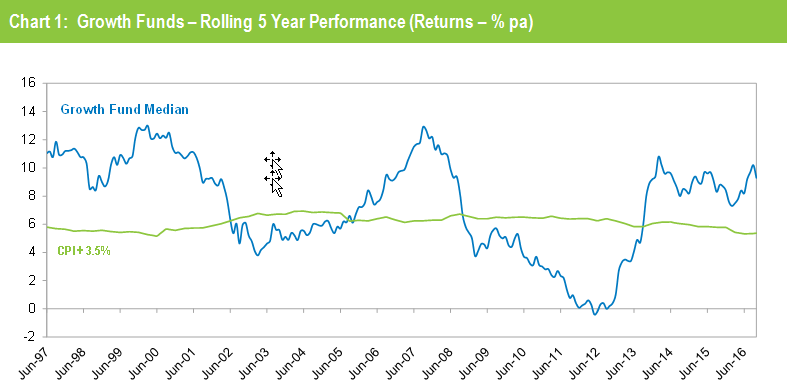

Chart 1 compares the performance since July 1992 – the start of compulsory superannuation – of the Growth category median with the typical return objective for that category (CPI plus 3.5% per annum after investment fees and tax over rolling five year periods). The healthy returns in recent years, combined with the GFC period having worked its way out of the calculation, have seen the five year return continue to track well above that CPI plus 3.5% target.

Source: Chant West

Note: The CPI figure for October 2016 is an estimate.

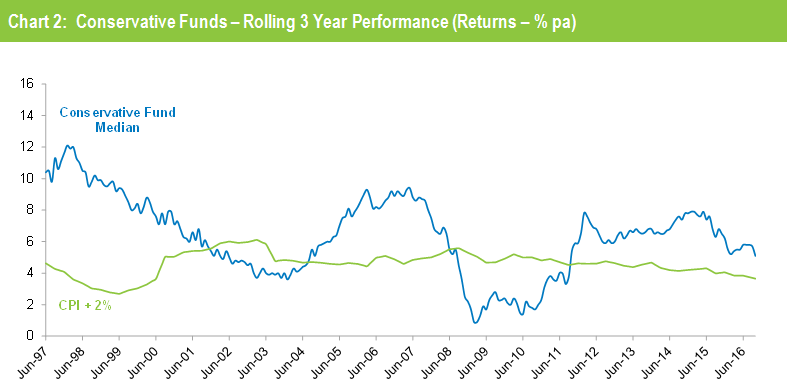

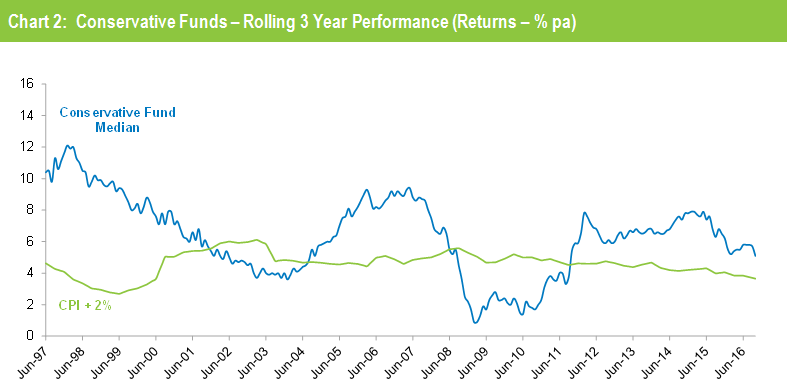

Chart 2 compares the performance of the lower risk Conservative category (21 to 40% growth assets) median with its typical objective of CPI plus 2% per annum over rolling three year periods. It shows that Conservative funds have also exceeded their objective in recent years.

Source: Chant West

Note: The CPI figure for the October 2016 is an estimate.

Industry funds and retail funds in line in October

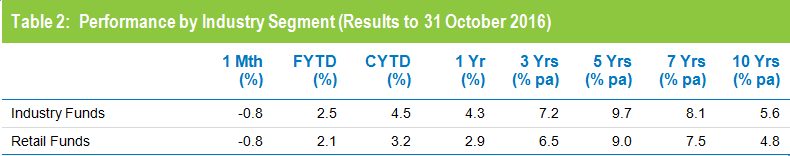

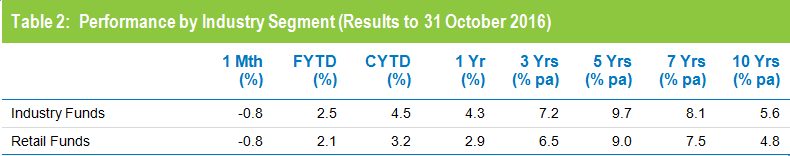

Industry funds and retail funds performed in line with each other in October with a return of -0.8%. However, industry funds continue to hold the advantage over the longer term, having returned 5.6% per annum against 4.8% for retail funds over the ten years to October 2016, as shown in Table 2.

Source: Chant West

Note: Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions.