After surging in July, super funds delivered a more modest gain in August with the median growth fund (61 to 80% allocation to growth assets) rising 0.3%. This brings the cumulative return for the first two months of the 2016/17 financial year to 3%.

Listed share markets, which are the main drivers of growth fund performance, were mixed in August. Australian shares were down 1.6%, but international shares were up 0.5% on a hedged basis and 1.3% in unhedged terms. Listed property was down, with Australian and global REITs falling 2.7% and 2.2%, respectively.

Chant West director, Warren Chant says: "We had two straight positive months to open this financial year, but the past couple of weeks have seen markets become more jittery amid growing expectations of a further interest rate hike in the US, so some of those earlier gains have been given back.

"This nervous mood is likely to continue while there's still uncertainty about global interest rates, the outcome of the US election and the consequences of Brexit, among other concerns. Most asset sectors are now fully valued or close to it, so it's hard to find reliable sources of real return. Super funds are going to find it tough to meet their long-term objectives, and members need to remain patient and recognise that in this low growth / higher volatility environment they're likely to experience a period of lower returns.

"In August, markets in the Eurozone were helped by a strong earnings season which saw a surprising number of companies exceeding market expectations. In Britain, meanwhile, the Bank of England launched a series of monetary easing measures in the wake of the uncertainty following the Brexit vote.

"Mixed economic data in the US, including weaker than expected retail sales, have led to speculation about the timing of the next interest rate rise. While this timing issue is dominating market sentiment, far more important will be the pace at which rates are increased over the next few years. The Federal Reserve will be concerned not to risk stalling the economic recovery, while at the same time trying to stave off any breakout in the rate of inflation beyond its target range.

"Closer to home, there remains concern over the pace of growth of the Chinese economy where further monetary easing is expected. Meanwhile, back in Australia, the RBA kept interest rates on hold at 1.5%, with a further cut this year remaining a possibility."

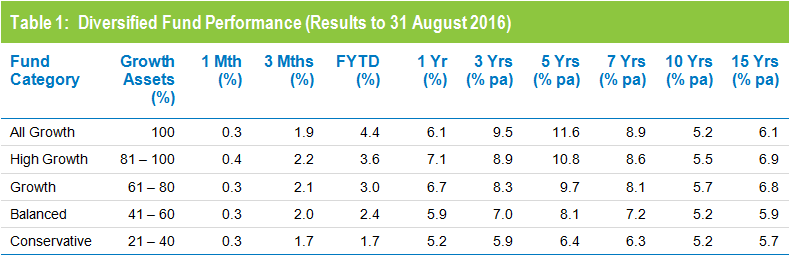

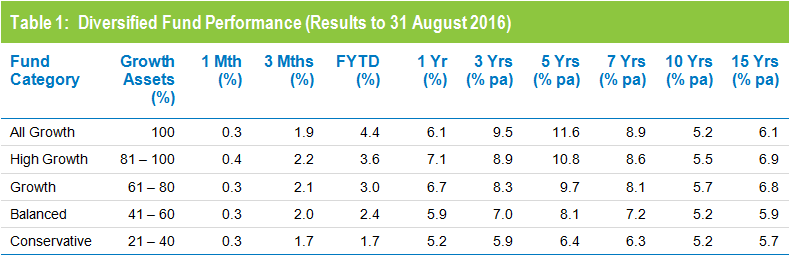

Table 1 shows the median performance for each category in Chant West's multi-manager survey, ranging from All Growth to Conservative. Over three, five and seven years, all risk categories have met their typical long-term return objectives, which range from CPI + 2% for Conservative funds to CPI + 5% for All Growth. However, the GFC continues to weigh down some of the longer-term returns. Over 10 and 15 years, the Growth, Balanced and Conservative funds achieved their objectives but the higher risk All Growth and High Growth funds fell slightly short, having been hardest hit during the GFC.

Source: Chant West

Notes: Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions.

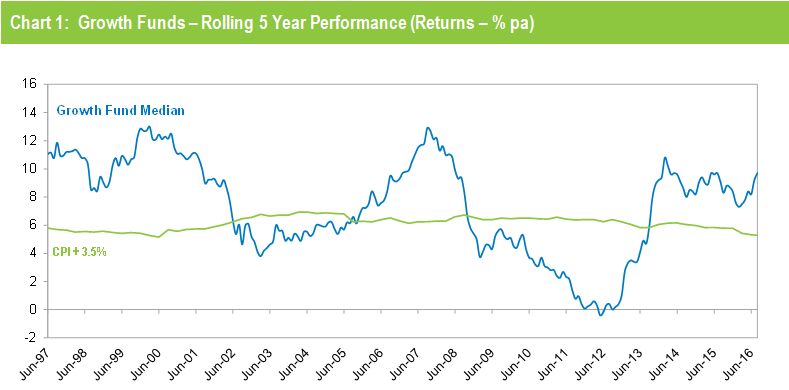

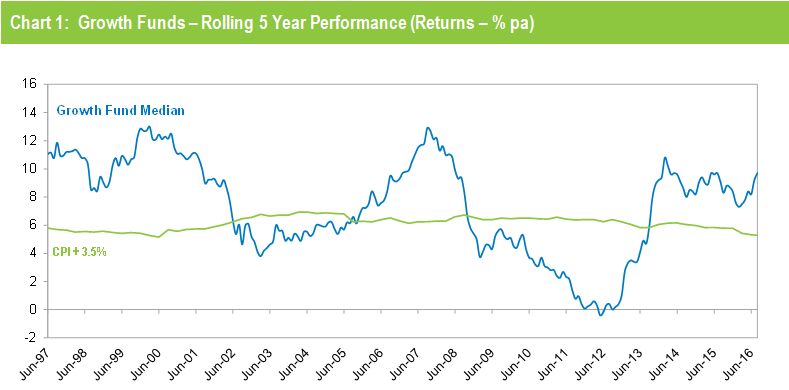

Chart 1 compares the performance since July 1992 – the start of compulsory superannuation – of the Growth category median with the typical return objective for that category (CPI plus 3.5% per annum after investment fees and tax over rolling five year periods). The healthy returns in recent years, combined with the GFC period having worked its way out of the calculation, have seen the five year return continue to track well above that CPI plus 3.5% target.

Source: Chant West

Note: The CPI figures for July and August 2016 are estimates.

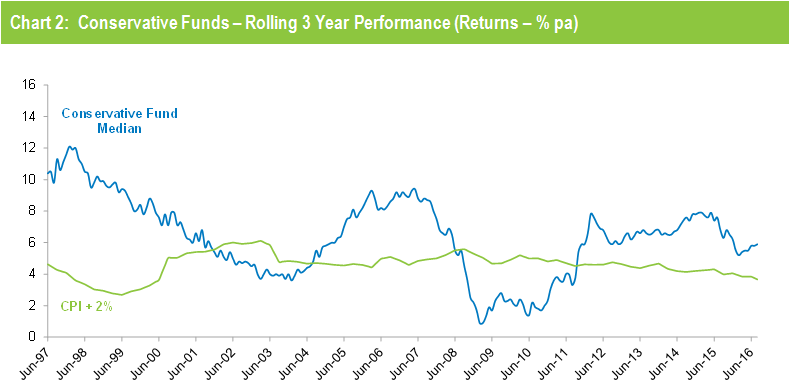

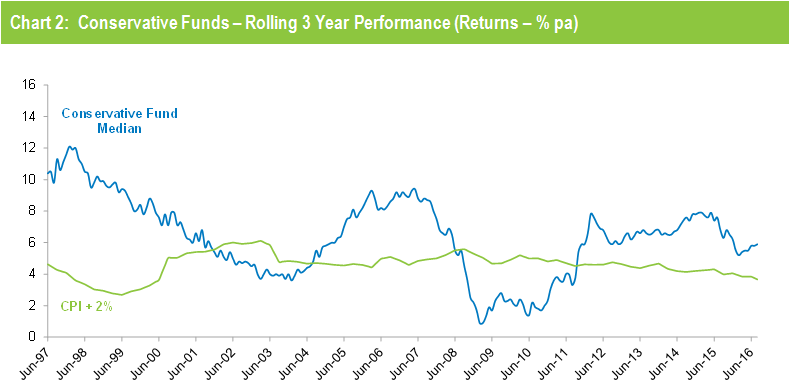

Chart 2 compares the performance of the lower risk Conservative category (21 to 40% growth assets) median with its typical objective of CPI plus 2% per annum over rolling three year periods. It shows that Conservative funds have also exceeded their objective in recent years.

Source: Chant West

Note: The CPI figures for July and August 2016 are estimates.

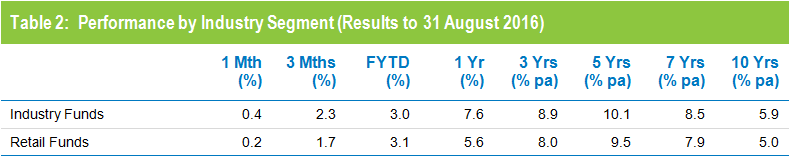

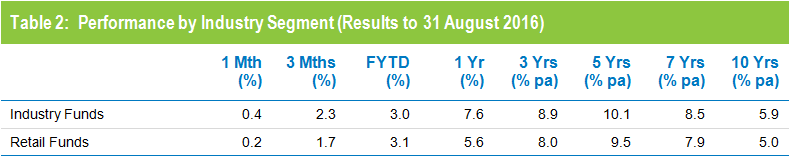

Industry funds outperform retail funds in August

Industry funds slightly outperformed retail funds in August, returning 0.4% versus 0.2%. Industry funds also continue to hold the advantage over the longer term, having returned 5.9% per annum against 5% for retail funds over the ten years to August 2016, as shown in Table 2.

Source: Chant West

Note: Performance is shown net of investment fees and tax. It does not include administration fees or adviser commissions.