The rapid spread of COVID-19 and its potential impact on the global economy drove a worldwide sell-off in share markets in March. This resulted in the median growth superannuation fund (61 to 80% in growth assets) falling 9% for the month and 10.1% for the quarter. The return for the first nine months of the financial year also turned negative at -6.3%.

Chant West senior investment research manager Mano Mohankumar says: "As a result of COVID-19 and the ensuing market turmoil, we know that the most important questions on fund members' minds are: "What should I do with my super? Should I switch to cash?".

"Chant West's core mission is to help people make better decisions about their super, and the best help we can give at the moment is to inform people of the facts, provide some reassurance and perspective, and caution about the potential dangers of abandoning a long-term investment strategy (which is what superannuation is) in favour of short-term actions based on fear.

"It's a difficult time financially for many Australians, and the last thing we want is for fund members to hurt themselves further – especially now the Government has created a once-off opportunity for people to withdraw up to $20,000 from their super accounts. Those most likely to need to access super through early release are young workers who have no other savings to fall back on. Most of their super accounts will be invested in growth assets which will have fallen in value. So if they take money out they will be doing the very thing we caution against, which is to lock in what at the moment are only paper losses. In time they may find a way to replace the funds they've withdrawn, but the chances are they will be buying back those same growth assets at much higher prices. Those losses, when compounded over many years, will knock a big hole in their eventual nest eggs. Clearly, for those who have lost their jobs and have no other savings to fall back on, such a withdrawal may well be necessary. But for those who can get by without early access, it should really be viewed only as a last resort as the long-term consequences may be much greater than the short-term benefit.

"There's also a natural tendency when markets fall sharply to think about moving money into less risky investment options with a view to switching back later. But trying to time markets is a risky proposition at any time. As we've said, panicking now only converts paper losses into real ones. Not only that, you also risk missing out when markets rebound as they will at some point. Even people close to retirement can mostly afford to take a long-term view. That's because most don't take out all their super when they retire so their money remains in the system in the pension phase, often for many years, which provides time for losses to be recovered.

"So we encourage everyone – younger and older – to remember that superannuation is indeed a long-term investment. The vast majority of members can afford to remain patient and, if you're thinking about withdrawing money or switching to a less risky option, we strongly encourage you to seek financial advice before doing so.

Quality investments and diversification will weather the storm

"It's too early to tell what the full economic impact of the virus will be, but members should be able to take some comfort from history. Market corrections do occur, often after a sustained period of growth such as we've seen in recent years. Super has had a record run, and it had to come to an end at some time. This downturn is a shock, but it's reassuring to look at history which shows that in 100% of previous corrections, markets do recover. The timing of when that recovery begins and how long it takes are unknown – but it will happen.

"While it's hard for members to see their balances fall so sharply, it's very important not to lose faith in superannuation. Super funds have delivered on their promises over the long term. They've weathered previous set-backs, including the seemingly disastrous GFC. They've done so by investing in quality assets and diversifying widely to control risk. Growth funds, which is where most Australians have their superannuation invested, hold diversified portfolios that are spread across a wide range of growth and defensive asset sectors. This diversification works to cushion the blow during periods of share market weakness. So while Australian and international shares were down 27% and 20% from the end of January to the end of March, the median growth fund's loss was limited to 11.7%. This is still a significant reduction in account balances, but it comes on the back of the tremendous 10-year run funds have had since the end of the GFC. Over the 2019 calendar year alone, growth funds returned an exceptional 14.7%, so super funds are actually ahead of where they were at the start of last year, even after what we've seen in February and March.

"In all of this analysis we haven't taken into consideration what has happened in April so far, when share markets have recouped some of their recent losses. Australian shares and international shares are up 8.3% and 8.9%, respectively, for the month to date. Our estimated return for April to date for the median growth funds is currently 3.8%. That's a positive sign, but we're far from out of the woods. While markets invariably move ahead of economies, this rebound may well be a relief rally – that is, relief that the spread of the virus in developed countries is slowing so that, in health terms, the worst may be over. In economic terms, the extent of the damage is still the great unknown and we may well see the pessimistic selling resume when more hard data is released over the coming months.

"Business confidence and consumer confidence have collapsed, and we know we are set for a global recession. The real question for investors is what pattern that recession will take. One thing we do know from history is that markets bounce back much quicker than the economies. In other words they anticipate what will happen 6 or 12 months ahead. Whether this recovery turns out to be quick or slow, we should expect heightened volatility to continue as investors react to good or bad news."

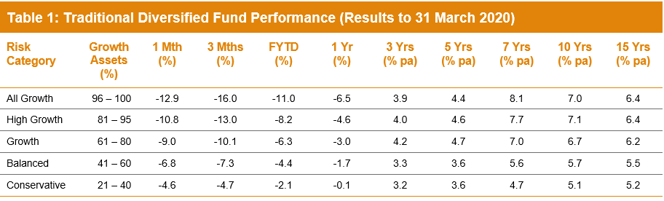

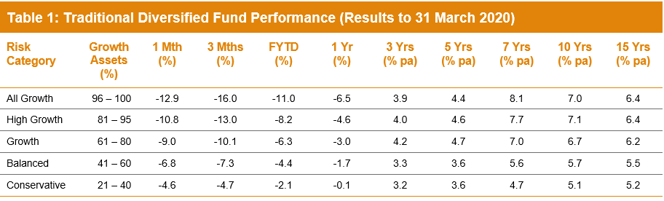

Table 1 compares the median performance for each of the traditional diversified risk categories in Chant West's Multi-Manager Survey, ranging from All Growth to Conservative. Naturally, the large losses over February and March have had a flow-on effect, particularly on the shorter-term numbers. However, despite these losses all risk categories have met their typical return objectives over 7 and 10 years. Over 15 years, only the highest risk All Growth and High Growth categories fell slightly short of their objectives. But we need to remember that the 15-year return also includes the full GFC period during which Growth funds lost about 26% and the All Growth and High Growth categories were even worse affected.

Note: Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions.

Source: Chant West

Lifecycle products behaving as expected

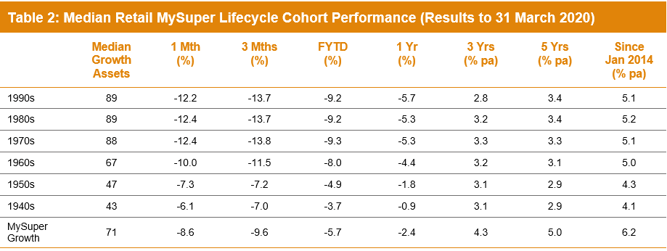

Mohankumar says, "While our Growth category is still where most people have their super invested, a meaningful number are now in so-called 'lifecycle' products. Most retail funds have adopted a lifecycle design for their MySuper defaults, where members are allocated to an age-based option that is progressively de-risked as that cohort gets older."

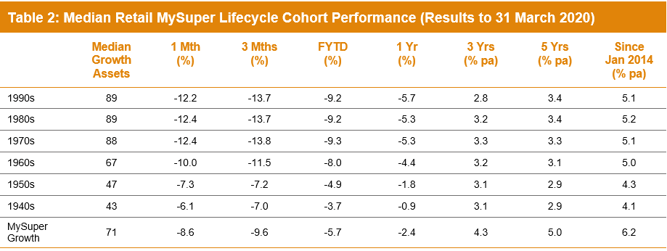

It's difficult to make direct comparisons of the performance of these age-based options with the traditional options that are based on a single risk category, and for that reason we report them separately. Table 2 shows the median performance for each of the retail age cohorts, together with their current median allocation to growth assets. It also includes a row for traditional MySuper Growth options for comparison – over 90% of which are not-for-profit funds. Care should be taken when comparing the performance of the retail lifecycle cohorts with the median MySuper Growth option, however, as they are managed differently so their level of risk varies over time.

Notes:

1. Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions.

2. January 2014 represents the introduction of MySuper.

Source: Chant West

The current setback has reversed the recent pattern of strong returns from growth assets. As a result, those options that have higher allocations to growth assets have done worse over the short term, ie all periods up to one year. Over longer periods those higher-risk options, which cover the younger cohorts born in the 1960s or later, have generally performed slightly better, although not as well as the median MySuper Growth option.

The older age cohorts (those born in the 1950s or earlier) are relatively less exposed to growth-orientated assets. Capital preservation is more important at those ages so, while they miss out on the full benefit in rising markets, older members in retail lifecycle options are better protected in the event of a market downturn such as the one we’re currently experiencing.

The reason the retail lifecycle options have underperformed the MySuper Growth option is that, while they are generally well-diversified, they don't have the same level of diversification as many of the not-for-profit funds. This is mainly due to the not-for-profit funds' higher allocations to unlisted assets (unlisted property, unlisted infrastructure and private equity) – about 21% on average. This compares to the retail lifecycle fund averages of 3% for older cohorts and 5% for younger cohorts (but a few have 10-14% unlisted asset allocations for younger cohorts). These assets have been proven to add value over the long term, not just for their diversification qualities but also because they generate an illiquidity premium in their returns relative to listed markets. However, any performance comparison at the end of March is further complicated by the fact that some funds have devalued their unlisted assets but others have not (including both not-for-profits and retail funds).

What about unlisted asset valuations?

Because unlisted assets are valued less frequently than their listed counterparts, some commentators are describing their current values as artificially high. We would argue that, on the contrary, unlisted valuations are generally a better representation of fair value than listed market valuations which are often influenced by investor sentiment. We know that listed markets tend to overshoot in good times and undershoot in bad times, so in a crisis this can drag prices down a lot further than where they should be. For example, Australian listed property prices fell 35% in March but have rebounded nearly 15% in April so far.

In the current market crisis, many super funds invested in unlisted assets (both not-for-profit and retail) are acting responsibly by proactively conducting out-of-cycle revaluations – in other words bringing forward valuations for parts of their portfolios. These revaluations have typically resulted in write-downs of between 6% and 10% for property and infrastructure and up to 15% for private equity. The reason those revaluations are not as dramatic as we've seen in listed markets is that the process is unemotional.

To arrive at a value for an unlisted property or infrastructure asset, for example, independent professional valuers apply well-proven methodologies based (among other things) on projected cashflows, demographic modelling, structural changes in industries and appropriate discount rates for future income flows. Unlike the share market, fear and greed play no part in setting prices.

Once again, any performance comparison at the end of March must be treated with caution since some funds have devalued their unlisted assets but others have not. We expect further revaluations over the next few months.

Long-term performance remains above target

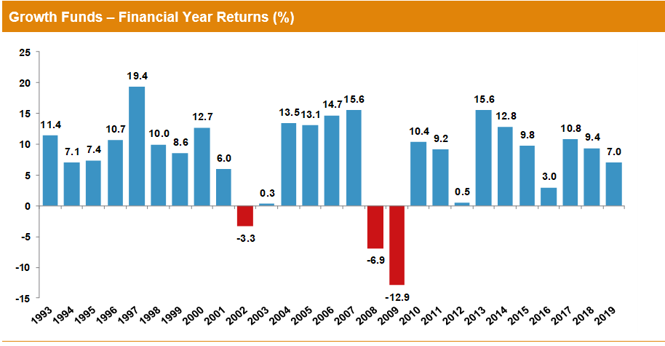

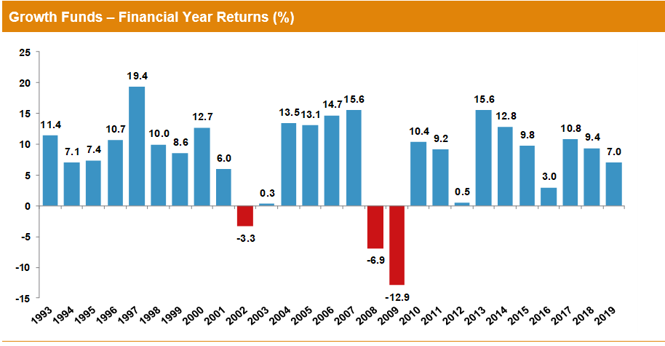

MySuper products have only been operating for just over six years, so when considering performance it is important to remember that super is a much longer-term proposition. The chart below plots the year by year performance of the median growth fund over the previous 27 full financial years since the introduction of compulsory super. Taking that entire period along with the current financial year to date, where growth funds are down 6.5% on average, the annualised return is 7.9%. The annual CPI increase over the same period is 2.4%, giving a real return of 5.5% per annum – well above the typical 3.5% target. Even looking at the past 20 years, super funds have returned 6.2% per annum, which is in line with the typical return objective. Let's not forget that the 20-year period now includes three share market downturns – the 'tech wreck' in 2001–2003, the GFC in 2007–2009 and now COVID-19.

It seems probable, but not certain, that the current financial year will produce a negative return. If so, that would be the fourth negative year in 28, an average of one every seven years. The typical risk objective for growth funds is no more than one negative year in five, so even if this year is negative it will still be well within the expected risk parameters.

Note: Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions.

Source: Chant West

International share market returns in this media release are sourced from MSCI. This data is the property of MSCI. No use or distribution without written consent. Data provided “as is” without any warranties. MSCI assumes no liability for or in connection with the data. Product is not sponsored, endorsed, sold or promoted by MSCI. Please see complete MSCI disclaimer.