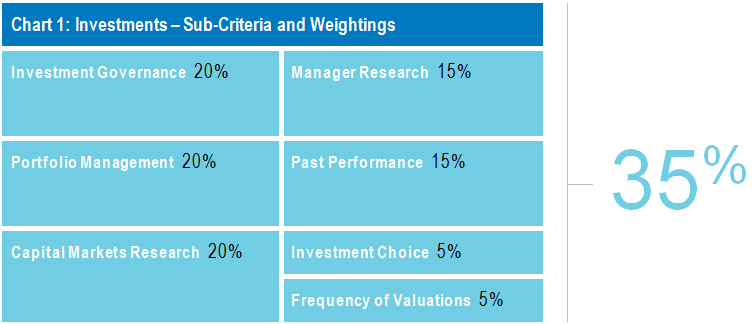

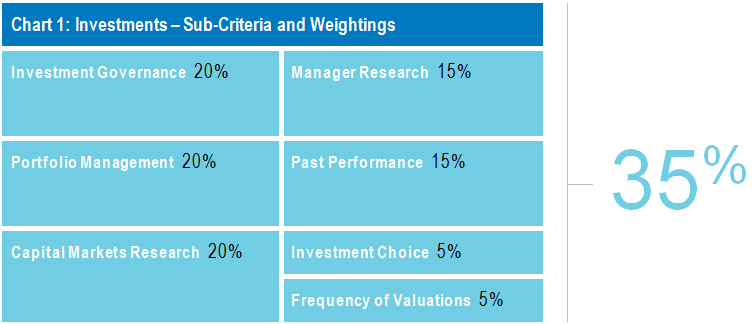

Investment is the single most important aspect of superannuation, so it is only natural that it carries the highest weighting (35%) in our fund rating process. While we take performance numbers into account, there are other factors that we consider far more important in determining whether funds are likely to deliver the best outcomes for their members over time.

What we are looking for when we assess a fund's investments is how it stacks up against industry best practice in terms of investment governance, research, asset allocation, manager selection and portfolio construction. That 'best practice' concept is dynamic, because with some funds growing so quickly, their new-found scale presents them with fresh challenges and opportunities.

Our main focus is on the quality of the fund's investment governance, its in-house investment team, its primary asset consultant and the extent of diversification in its portfolios. If it does all these things well, it is likely to have strong, long-term performance.

Chart 1 shows the sub-criteria we take into account. It is worth noting that past performance only accounts for 15% of the total score for investments (which equates to 5.25% of our overall fund evaluation).

Source: Chant West

Good governance is essential

Over the years, we have seen the importance of good governance increase, if anything. Regardless of the investment model that the fund adopts – and there are several that have proved successful – what really matters is having the right people being responsible for the right investment decisions at the right time.

The diversity of successful investment models is evidenced by the fact that the winners of our Best Fund: Investments award over the past three years (RES in 2013, AustralianSuper in 2014 and UniSuper this year) all operate different models. But what they all have in common is people of exceptional quality, experience and integrity making the key decisions.

To us, good governance requires:

- An Investment Committee that sits separate from the Trustee Board so that the Board is only involved in higher-level strategic decisions, leaving investment decision-making to the Committee;

- The Investment Committee to include people with relevant investment experience who can authoritatively question or challenge recommendations made by their in-house team or external asset consultants;

- A high degree of delegation from the Investment Committee to the in-house team to enable timely and efficient implementation of investment decisions.

Scale is the game-changer in portfolio management

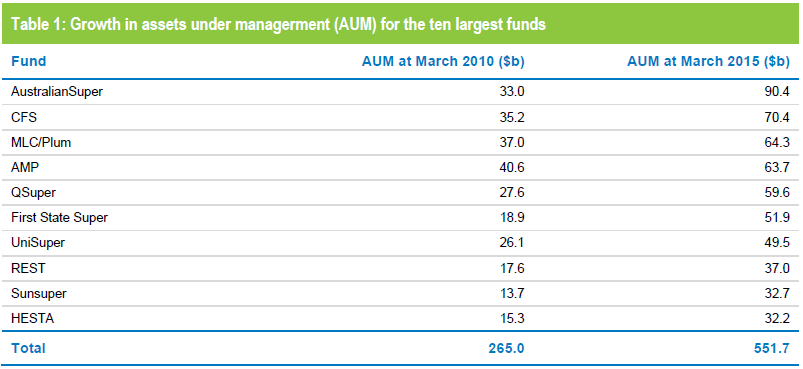

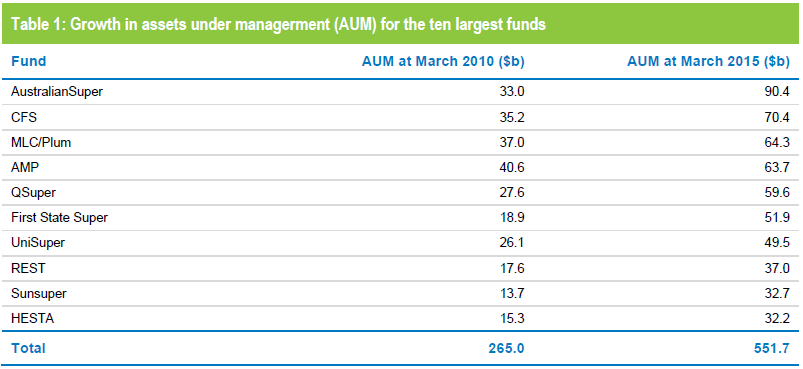

Contribution flows, fund consolidation and rising investment markets have resulted in massive growth in some of our major funds. Table 1, for example, shows the increase in assets under management for the ten largest funds over the 5 years to 31 March 2015.

Source: Chant West

Increasing scale has implications for how funds manage their investments, and for some the answer has been to develop an in-house investment capability. There are three main reasons for doing so.

Firstly, it can deliver cost savings that can be passed on to members, because an in-house team is a relatively fixed cost whereas external manager fees are asset-based and therefore increase over time. Secondly, in-house management helps overcome the issue of capacity constraints that may be encountered with external managers. Thirdly, in some asset classes external managers have difficulty in generating meaningful net alpha after fees so, if the in-house team is suitably skilled, they should be able to produce similar or better performance at a lower cost.

To do in-house investment well, funds need to attract professionals with the necessary skills and hands-on experience in funds management. Happily, there are such people who prefer to focus exclusively on managing money, without the distractions of working in a commercial funds management business.

One success story in this area is UniSuper, winner of our 2015 Best Fund: Investments award. Since 2009, the fund has increased internal management from zero to 55% of total assets i.e. about $28 billion. To do this, CIO John Pearce hired senior portfolio managers with considerable direct investment experience. The team also has the support and oversight of an Investment Committee where five members have either been CEOs or held very senior positions at major funds management businesses and the sixth is a professor of finance at a leading university.

Changing role for asset consultants

Capital markets research and manager research are important in our assessment of a fund's investments, and they carry weights of 20% and 15%, respectively, in our scoring system.

Conventionally, this research has been conducted by the fund’s principal asset consultant, and that is still the case for many funds. That is why we pay a lot of attention to the quality of the consultant and how they interact with the fund in decision-making.

However, for some of the larger funds that have developed their own in-house investment capability, the relationship with their asset consultants, while still important, has evolved into something different. As these funds have strengthened their in-house expertise, they've typically become less reliant on their principal asset consultant for deep asset class insights and manager selection. The focus of the asset consultant is now more on asset allocation advice, new ideas within the context of the diversified portfolios and research on emerging managers.

Small to medium-sized funds that typically have small internal teams are more reliant on their asset consultant for both research and portfolio construction. Many funds, large and small, are also now using specialist consultants in the non-traditional asset classes.

Same objective, different approaches

From our long-term appraisal of funds and their investment approaches, we can see clearly that there is no single 'right' way. Rather, there are different approaches that reflect each fund’s history, its membership demographics and the beliefs and philosophies of its Board and management.

Our focus is on diversified portfolios, because these are what the vast majority of members invest in. In terms of investment philosophy and beliefs, some of the factors we take into account are the fund's views on strategic asset allocation, active asset allocation (i.e. portfolio 'tilts' and currency management) and active versus passive management.

On this last point of active or passive management there are widely divergent views. Some funds – and REST is a prominent example – are strong believers in the ability of active management to add value net of fees in almost all asset classes. Others take the view that active management is a zero sum game, that over time managers struggle to beat the index and that it is better to save costs by taking a passive, indexed approach.

Our own view, based on our research over 18 years, is that active management does add value. Having said that, we recognise that there is a place for passive management in some sectors. What we do not like to see is the widespread use of passive management primarily for reasons of cost reduction. A purely passive diversified portfolio locks members out of assets such as unlisted property, unlisted infrastructure, private equity and hedge funds, which have shown over the longer term that they can add value to diversified portfolios and provide a smoother ride for members.

Of course funds need to consider their cash flows before they commit significant amounts to these illiquid assets. Also, they need to have the capability to assess and source the better assets in these sectors. This again is partly a function of scale, and what works for some of the largest funds may be inappropriate for funds of lesser size.

Finally, to performance

As mentioned earlier, performance is a relatively small contributor to our investment ratings with a weighting of 15%.

We tend to focus more on longer-term returns (over 7 to 10 years) than on the short-term numbers. We do recognise, however, that changes can occur over those longer periods, such as restructuring of portfolios, significant changes to the investment team, investment governance regime, asset consultant etc. So, we do pay some attention to short to medium-term performance where a fund’s investments have undergone significant changes or where we see anomalies such as the fund not performing how we would expect in the prevailing market conditions. This may act as a trigger for further investigation.

Typically, we find that those funds with strong investment governance, research and portfolio management capabilities tend to deliver strong long-term performance.